Transcritical Co2 Market Size and Share

Transcritical Co2 Market Analysis by Mordor Intelligence

The Transcritical Co2 Market size is estimated at 0.54 Billion tons in 2025, and is expected to reach 1.25 Billion tons by 2030, at a CAGR of 18.34% during the forecast period (2025-2030).

This rapid expansion reflects how environmental rules, especially the EU F-Gas Regulation, are driving a wholesale shift toward natural refrigerants with near-zero climate impact. Efficiency gains from ejectors, parallel compression, and liquid-piston compressors are shrinking operating costs, giving end users a clear financial incentive to abandon high-GWP refrigerants. Growth is also fueled by emerging high-temperature heat pumps that push outlet temperatures to 124 °C, opening new industrial process-heat revenue streams and broadening the appeal of the transcritical CO2 market.

Key Report Takeaways

- By component, compressors held a 35% revenue share in 2024, while gas coolers exhibited the fastest growth at a 19% CAGR.

- By function, refrigeration captured 68% of the transcritical CO2 market share in 2024; heating applications are projected to expand at a 19.23% CAGR to 2030.

- By installation type, new-build projects commanded 75% of the transcritical CO2 market size in 2024 and continue to lead with a 19.66% CAGR.

- By application, supermarkets accounted for 75% share of the transcritical CO2 market size in 2024 and are advancing at a 19.42% CAGR through 2030

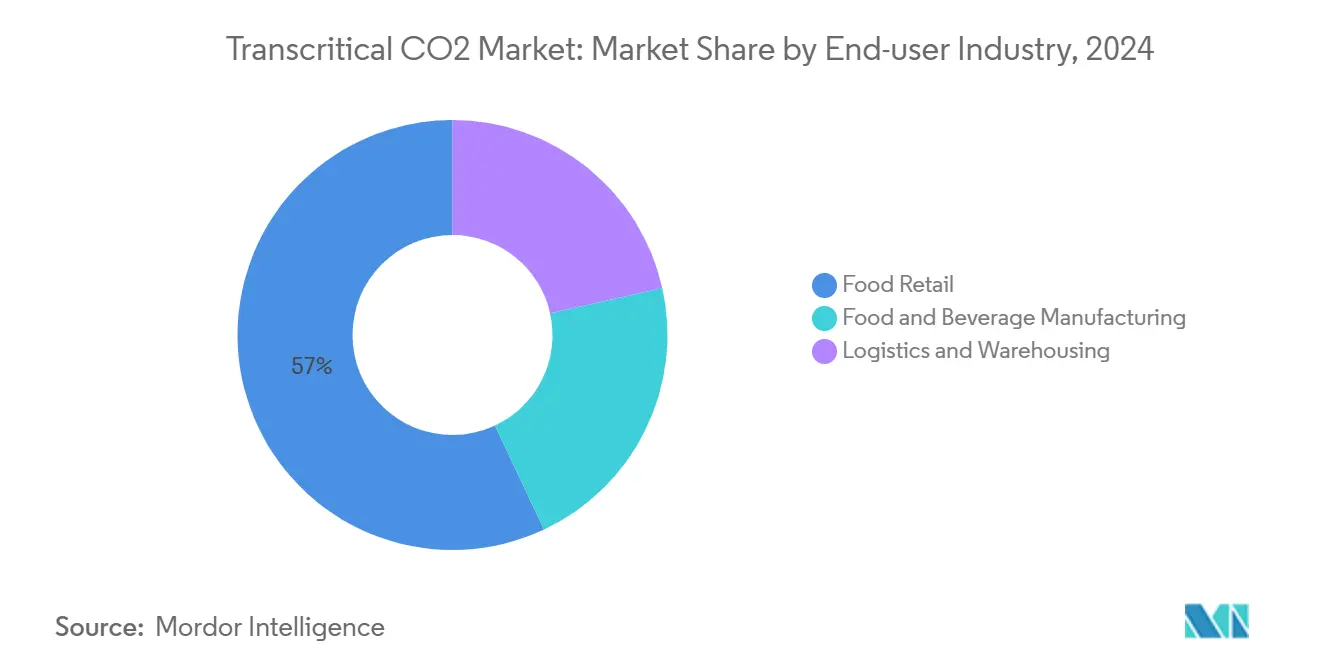

- By end-user industry, food retail dominated with 57% share in 2024; logistics and warehousing is the fastest-growing segment at a 19.1% CAGR to 2030.

- • By geography, Europe dominated with 78% shares in 2024 and is also the fastest growing with an 18.77% CAGR.

Global Transcritical Co2 Market Trends and Insights

Driver Impact Analysis

| Drivers | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Stringent F-Gas Phase-Down in Europe and Canada | +6.2% | Europe, North America | Short term (≤ 2 years) |

| Increasing Demand from Super Markets and Convenience Stores Segment | +4.8% | Global, with concentration in Europe and North America | Medium term (2-4 years) |

| Rising Demand from Food Processing and Storage Facilities Segment | +3.1% | Global, with emphasis on developed markets | Medium term (2-4 years) |

| Rising demand for natural refrigerants with low environmental impact | +2.9% | Global, with early adoption in Europe | Long term (≥ 4 years) |

| Decreasing costs of CO₂ systems due to scale and innovation | +1.8% | Global | Long term (≥ 4 years) |

Source: Mordor Intelligence

Stringent F-Gas Phase-Down Accelerates Adoption Timelines

Quota cuts under the EU’s 2024 F-Gas revision have raised HFC prices by up to 400% and forced retailers to accelerate equipment replacement schedules. Similar legislation in Canada and forthcoming AIM Act rules in the United States align global compliance horizons, allowing manufacturers to scale component production and reduce per-unit cost. As supply chains standardize around CO₂ specifications, cross-border equipment certification has become simpler, lowering engineering hours per installation. These synchronized policies have therefore moved transcritical systems from a long-term sustainability option to an immediate business requirement[1]UK Department for Environment Food & Rural Affairs, “F-Gas Regulation in Great Britain,” assets.publishing.service.gov.uk.

Supermarkets Drive Innovation Through Scale and Integration

Chain grocers now specify CO₂ racks with integrated heat reclaim that cool cabinets, warm store aisles, and feed domestic hot-water loops in one circuit. Store retrofits between 2023 and 2025 show energy demand dropping 55-60% when advanced cabinet doors and ejector-assisted parallel compression are combined. Payback periods have narrowed to 3-5 years, creating a replicable template for smaller convenience formats. Modularity requirements from this sector have steered OEM product roadmaps, pushing for plug-and-play gas coolers and condensing units that shorten onsite build times.

Food Storage Facilities Prioritize Temperature Precision and Reliability

Cold rooms using transcritical CO₂ maintain temperature swings within 1 degree Celsius, safeguarding protein, producing quality, and extending shelf life. Operators also appreciate the technology’s ability to multitask from blast freezing at −40 degrees Celsius to chilled storage near 2 degrees Celsius on one central plant, trimming capital outlay and floor space. AI-enabled controls now predict compressor wear, cutting downtime by 35% and keeping throughput constant during peak harvest seasons.

Natural Refrigerants Gain Momentum Beyond Environmental Benefits

With a GWP of 1 and no future phase-out risk, CO₂ offers hedge value against evolving climate policy. Thermodynamic advantages, such as high volumetric capacity, allow smaller compressor frames, while free heat recovery can cover 100% of space-heating loads in temperate regions. Field data from Nordic installations confirm energy savings of up to 30% over optimized HFC systems, even before carbon-price credits are counted.

Restraint Impact Analysis

| Restraints | % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Lack of Awareness About Transcritical CO2 Systems | -1.2% | Global, with emphasis on developing markets | Medium term (2-4 years) |

| High initial installation and equipment costs | -2.4% | Global, more pronounced in price-sensitive markets | Short term (≤ 2 years) |

| Slower adoption outside of Europe due to regulatory gaps | -1.8% | North America, Asia Pacific, Latin America, MEA | Medium term (2-4 years) |

Source: Mordor Intelligence

Technical Complexity Creates Implementation Barriers

Operating pressures that approach 120 bar demand special piping, valves, and rigorous commissioning processes. A 2024 contractor survey showed 68% citing limited training as their top barrier to bidding on CO₂ jobs. Industry associations have expanded certification programs, yet field capacity still lags demand, extending project timelines in North America and Asia. Digital twin tools are emerging to streamline design, but widespread proficiency is unlikely before 2027.

Initial Cost Premium Challenges ROI Calculations

For small stores or light-industrial sites, a 15-30% capital premium over HFC systems can stall board approval despite favorable lifetime economics. Although component prices have fallen roughly 8-10% per year since 2023, interest-rate volatility keeps payback scrutiny high. Scale economies from Europe’s mature supply chain are gradually spilling into other regions, narrowing cost gaps for 20–200 kW plants. Financial incentives tied to decarbonization targets are further softening the upfront hurdle.

Segment Analysis

By Component: Gas Coolers Drive Efficiency Improvements

Compressors commanded 35% of 2024 revenue and remain the heartbeat of any rack design. Efficiency leaps, such as Danfoss’s BOCK HGX56 CO₂ T six-cylinder unit, deliver up to 135 kW of cooling while slashing discharge temperatures, lowering service intervals. Yet gas coolers are the fastest mover, growing 19% annually as OEMs refine microchannel fin packs and adopt adiabatic sprays that pull peak-summer EER up 25%.

High-pressure electronic expansion valves and adaptive controls now modulate flow at 120 bar with sub-second precision, driving 15-20% annual efficiency gains. Component improvements cascade into system-level performance, broadening the credible climate range of transcritical CO2 market installations and unlocking projects on every continent.

Note: Segment shares of all individual segments available upon report purchase

By Function: Heating Applications Gain Strategic Importance

Refrigeration remained the anchor of the transcritical CO2 market in 2024, generating 68% revenue through thousands of supermarket, warehouse, and process-cooling deployments. Energy-saving upgrades, adiabatic gas coolers, ejectors, and parallel compression have improved warm-climate performance, keeping the segment on a double-digit growth path.

Heating, though smaller, is racing ahead at a 19.23% CAGR as factories and district-energy networks adopt high-temperature heat pumps that hit 124 °C outlet and COP levels above 3. When waste-heat integration is added, effective COP values climb past 5, turning what was a compliance-driven technology into a profitable decarbonization tool.

By Installation Type: New-Build Dominates Through Design Integration

Designing CO₂ infrastructure from day one avoids costly plant-room retrofits and allows architects to reclaim waste heat into HVAC layouts, giving new builds a 75% share in 2024. The total installed cost is 15-20% below comparable retrofits because there is no need for temporary cooling plants or phased switchover labor. The segment is expanding at a 19.66% CAGR as greenfield grocery, cold-storage, and industrial projects proliferate worldwide.

By Application: Supermarkets Lead Adoption and Innovation

Supermarkets controlled 75% of the 2024 demand, equaling the scale needed to pressure OEMs into serial production and component upgrades. A single 6,780 m² store near Stockholm logged a 55% drop in refrigeration power and a 64% cut in heating energy by switching to an integrated CO₂ rack with heat recover.

Rapid payback, reinforced by carbon-tax relief, means retail chains plan whole-portfolio roll-outs through 2030. The transcritical CO2 market continues to benefit from this predictable multiyear investment cycle, anchoring supply-chain capacity.

By End-User Industry: Logistics Sector Embraces Precision Control

Food retail delivered 57% of total volume in 2024, reinforcing the link between grocery decarbonization targets and transcritical technology. Chains value simultaneously meeting refrigeration, HVAC, and hot-water loads without fossil boilers.

Logistics and warehousing, however, are clocking the quickest growth at 19.1% CAGR. Cold-storage developers specify CO₂ racks to meet stricter ESG investor mandates and hedge against carbon levies. A newly opened 292,000 ft² Minnesota facility combines advanced racks with thermal-storage tanks, flattening demand peaks and securing LEED certification.

Note: Segment shares of all individual segments available upon report purchase

Geography Analysis

Europe commanded 78% of the 2024 volume, underpinned by the EU’s aggressive HFC phase-down and a mature ecosystem of specialized component makers. The region also posts the highest 18.77% CAGR as district-energy pilots adopt 3–10 MW CO₂ heat pumps connected to municipal networks, demonstrating megawatt-scale viability[2]International Energy Agency District Heating & Cooling, “Guidebook for Integration of Renewable Energy Sources into Existing District Heating Systems,” iea-dhc.org .

North America is rapidly catching up as AIM Act rules converge with Canadian thresholds, triggering a wave of supermarket rack orders and purpose-built cold stores. Asia Pacific shows mixed progress. Japan’s subsidy programs have driven thousands of convenience-store installations, while China’s first industrial blast-freezers and logistics hubs now trial 1–2 MW CO₂ skids for export cold chains.

South America and MEA remain early-stage; yet proof-of-concept plants, such as a renewably powered fish-cold-store in Cape Verde that cuts emissions 95%, illustrate viability even in hot, grid-constrained locales. Regional training alliances with European OEMs aim to close the skills gap by 2027, setting the stage for broader penetration.

Competitive Landscape

The transcritical CO2 market is moderately fragmented. Global leaders like Danfoss, Advansor, and Carrier leverage vertical integration, compressors, valves, and controls to guarantee turnkey compatibility and shorten commissioning. They pour research and development into warm-climate performance, a key differentiator that commands price premiums. Mid-tier specialists, often European, focus on bespoke rack engineering for industrial or marine niches, building reputations on customization rather than volume.

Transcritical Co2 Industry Leaders

-

Advansor A/S

-

BITZER Kühlmaschinenbau GmbH

-

CCR

-

Danfoss Industries Pvt Ltd

-

Hillphoenix

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- May 2025: Panasonic Corporation's subsidiary Hussman signed an exclusive agreement with Refra to supply transcritical CO₂ racks, chillers, and R290 heat-pump systems to the Australian market.

- February 2025: Panasonic Corporation's subsidiary, Hussmann Australia, unveiled a 20 HP transcritical CO₂ condensing unit targeting supermarkets and light industrial cooling.

Global Transcritical Co2 Market Report Scope

The Transcritical Co2 market report includes:

| By Component | Compressors | ||

| Gas Coolers | |||

| Valves and Controls | |||

| By Function | Refrigeration | ||

| Heating | |||

| Air-Conditioning | |||

| By Installation Type | New-Build | ||

| Retrofit | |||

| By Application | Commercial Refrigeration | ||

| Industrial Refrigeration | |||

| Super Markets | |||

| Others | |||

| By End-User Industry | Food Retail | ||

| Food and Beverage Manufacturing | |||

| Logistics and Warehousing | |||

| By Geography | Asia Pacific | China | |

| Japan | |||

| India | |||

| South Korea | |||

| Australia and New Zealand | |||

| Rest of Asia Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| Italy | |||

| France | |||

| Rest of Europe | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle East and Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| Compressors |

| Gas Coolers |

| Valves and Controls |

| Refrigeration |

| Heating |

| Air-Conditioning |

| New-Build |

| Retrofit |

| Commercial Refrigeration |

| Industrial Refrigeration |

| Super Markets |

| Others |

| Food Retail |

| Food and Beverage Manufacturing |

| Logistics and Warehousing |

| Asia Pacific | China |

| Japan | |

| India | |

| South Korea | |

| Australia and New Zealand | |

| Rest of Asia Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| Italy | |

| France | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East and Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is driving the rapid growth of the transcritical CO2 market?

Regulatory phase-downs of high-GWP refrigerants, supermarket demand for integrated heating and cooling, and efficiency gains from new component designs are propelling an 18.34% CAGR through 2030.

How large will the transcritical CO2 market be by 2030?

The transcritical CO2 market size is projected to reach 1,254.44 million tons by 2030, more than doubling its 2025 level.

Which application segment holds the largest share today?

Supermarkets lead with a 75% share in 2025 because integrated CO₂ racks meet refrigeration, space-heating, and hot-water needs in one system.

Why are gas coolers the fastest-growing component?

Heat-rejection performance limits overall efficiency; advances in microchannel fins and adiabatic pre-cooling add up to 25% energy savings, making gas coolers a 19%-CAGR segment.

What restrains adoption outside Europe?

High upfront cost premiums and a shortage of technicians trained to work at 120 bar pressures slow uptake, especially in developing regions.