Switzerland ICT Market Size

Switzerland ICT Market Analysis

The Switzerland ICT Market size is estimated at USD 129.27 billion in 2025, and is expected to reach USD 198.53 billion by 2030, at a CAGR of 8.96% during the forecast period (2025-2030).

- The Swiss economy relies heavily on information and communication technology (ICT), which permeates its economic and social landscape and plays a pivotal role in enhancing productivity across various sectors. The nation's adeptness in adopting new ICT solutions, coupled with the proficiency of its workforce, places Switzerland in a favorable position.

- Switzerland emerges as a prime ICT hub with a skilled workforce, advanced technology, a competitive tax structure, streamlined administration, and access to the European market; however, while the nation boasts these advantages, its high labor costs somewhat temper the growth potential.

- The Swiss market showcases a robust demand for hardware, advanced software, and security products. CRM, ERP, SCM, document and content management, application services, and e-procurement are in high demand. While CRM and data storage solutions lead the market, a notable rise is anticipated in financial applications, CAD/CAM software, security systems, and e-government solutions. While small and medium-sized businesses (SMBs) predominantly drive the demand for storage solutions, larger enterprises are also expanding their storage capacities.

- Further, the growing cloud market and the government aid is expected to bolster the market’s growth rate during the forecast period. For instance, in May 2024, Switzerland announced to invest CHF 320 million(~USD 354.80Million) into advanced cloud infrastructure for public administration. The inaugural features of this government cloud are slated for a 2026 rollout. Aligned with a broader digitalization drive, the Swiss Federal Council announced a CHF 246.9 million(~USD 273.42 Million) budget to revamp the existing public administration cloud infrastructure. The new system will be developed at the national Federal Office of Information Technology and Telecommunications (FOITT). The Federal Council estimates the project's total cost at CHF 319.4 million(~USD 353.71 Million).

Switzerland ICT Market Trends

Rapid Deployment of 5G Network Across the Nation

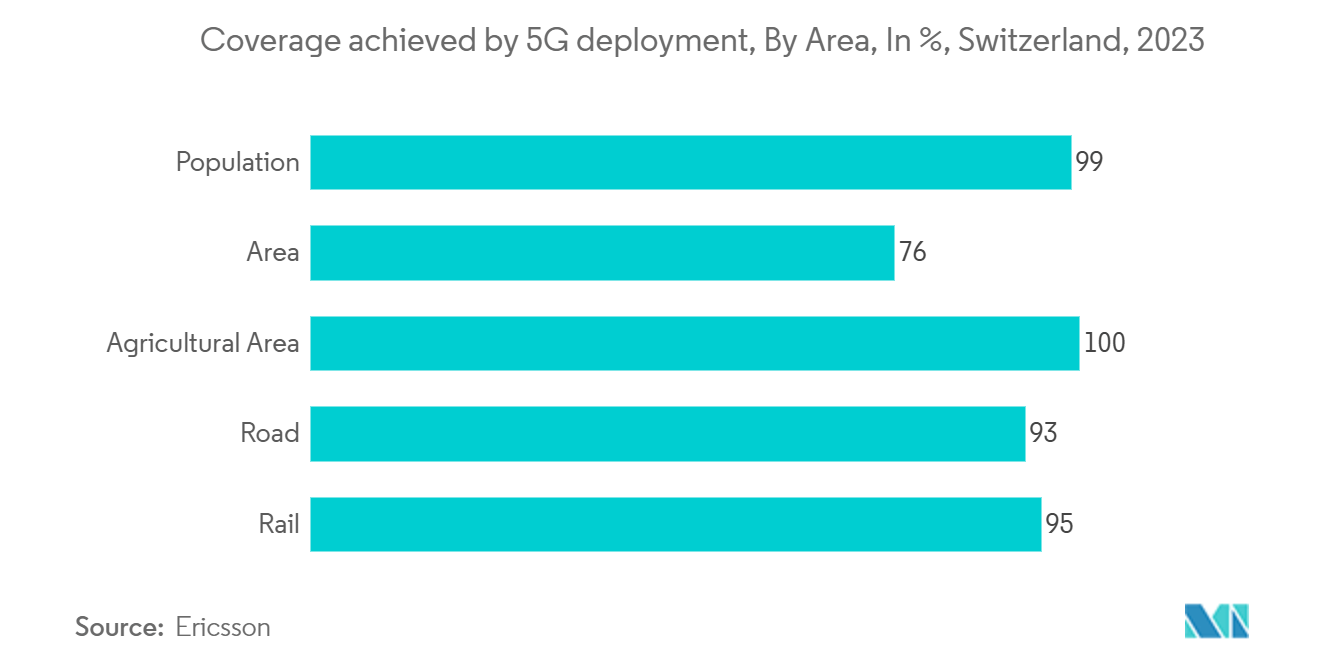

- In 2019, Switzerland became the first European nation to roll out commercial 5G services. ComCom, the country's telecom regulator, facilitated this milestone through a spectrum auction that encompassed bands like 700 MHz, 1400 MHz, and 3500 MHz.

- In April 2019, Swisscom became the first to launch commercial 5G in Europe. Collaborating with Ericsson, the telecom giant has been making significant efforts to deliver fast 5G speeds to Swiss consumers and businesses. Presently, Swisscom covers 96% of the Swiss populace with its 5G network. The company is expanding its 5G reach, bolstering capacity and coverage. This expansion is not limited to urban hubs; it extends to remote alpine areas and key transportation corridors.

- Further, in April 2024, Swisscom and Ericsson expanded their strategic alliance for three years. Ericsson will continue as the primary provider of both hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer service standards and advance its mobile network, emphasizing sustainability. By leveraging automation, artificial intelligence, and a heightened focus on innovation, Swisscom's network is set to undergo modernization, ensuring a sustained delivery of better customer experiences.

- Moreover, the growing collaborations in cloud could create significant opportunities for the 5G deployment. For instance, in November 2023, Genesys, one of the prominent cloud providers specializing in AI-driven experience orchestration, unveiled Switzerland as its newest full-service Genesys Cloud region. This expansion empowers a broader spectrum of organizations to transition to the cloud. Genesys equips businesses with the necessary controls to meet local regulatory standards by offering a secure data storage option in Switzerland. Leveraging the Amazon Web Services Europe Region, Genesys delivers its comprehensive contact center solution, Genesys Cloud, empowering businesses to harness advanced AI and digital tools. This, in turn, enables them to provide faster, more personalized experiences to customers and employees, all while upholding stringent security, compliance, and service-level benchmarks.

Retail and E-commerce is Analyzed to Hold a Significant Share in the Market

- The country is economically developed, and due to the high disposable income in the households, the demand for retail goods and consumer electronics products is increasing. This is expected to support the demand in the e-commerce market during the forecast period due to the application of e-commerce platforms to ease the buying process of retail consumers.

- The e-commerce sector in Switzerland is undergoing significant development, offering new possibilities and opportunities for businesses. With the increasing prevalence of the Internet, brands are expanding their online presence to cater to consumers' rising expectations and demands. Switzerland boasts a high internet connectivity rate, with approximately 97% of the population regularly using the Internet.

- Furthermore, nearly all Swiss residents, around 98%, are clients of a bank, a necessary prerequisite for conducting online purchases. Despite its relatively small size, Switzerland has many online merchants, making it an attractive location for e-commerce companies to operate. Switzerland's high living standards and disposable incomes further contribute to its appeal as a lucrative market for e-commerce ventures. Given these factors, Switzerland is witnessing increased investment and partnerships in the e-commerce industry, reflecting the growing opportunities and potential for growth in this sector.

- In December 2023, Unicorn Group, a prominent provider of online payment processing and multi-currency merchant services, announced a strategic partnership with Swiss Incorporation Companies to streamline the process for businesses seeking to establish an online presence. With the ongoing expansion of e-commerce, numerous businesses in Switzerland and beyond are seizing opportunities in the thriving Swiss market. By collaborating with Swiss Incorporation Companies, Unicorn Group aims to enhance its offerings and provide clients with cutting-edge online payment solutions tailored to their specific needs. This partnership enables businesses to swiftly integrate Unicorn Group's e-commerce payment platform into their websites, significantly reducing the time required for approval and implementation compared to traditional methods.

Switzerland ICT Industry Overview

The Swiss ICT market is analyzed to be semi-consolidated with a significant number of players in the country. The vendors in the country are partnering with various players in the market to sustain the market competition.

- April 2024: Swisscom and Ericsson expanded their strategic alliance for three years. Ericsson will continue as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer service standards and advance its mobile network, emphasizing sustainability. By leveraging automation, artificial intelligence, and a heightened focus on innovation, Swisscom's network is set to undergo modernization, ensuring a sustained delivery of better customer experiences.

- February 2024: Adnovum, a digital solutions and consulting company, and Squirro, an enterprise-grade Generative AI company, unveiled a strategic alliance to transform the banking, insurance, and public sectors. This partnership bolsters Adnovum's bespoke digital offerings, centering on software and security solutions, leveraging Squirro's cutting-edge technologies: artificial intelligence (AI), natural language processing (NLP), and retrieval augmented generation (RAG). The collaboration is poised to meet the evolving digital demands of these industries, forging a potent synergy.

Switzerland ICT Market Leaders

-

Microsoft Corporation

-

IBM

-

Swisscom

-

Google LLC

-

Adnovum

- *Disclaimer: Major Players sorted in no particular order

Switzerland ICT Market News

- March 2024: Swiss startup Hive, in a move to enhance accessibility to sustainable, high-powered computing resources, secured EUR 12 million(~USD 12.93 Million) in Series A funding. The round was led by SC Ventures, Standard Chartered's innovation and fintech investment arm. Notably, OneRagtime, the French venture capital fund that previously led Hive's seed round, and a consortium of private investors also participated in this funding initiative.

- November 2023: Over the next three years, PwC Switzerland is set to channel CHF 50 million (~USD 57 Million) into bolstering its artificial intelligence (AI) initiatives. This investment spans PwC's proprietary AI solutions, staff training, and enhancement of its AI Centre of Excellence. It underscores PwC's enduring dedication to AI, amplifying its capacity to craft advanced, client-centric solutions.

Switzerland ICT Industry Segmentation

The study tracks ICT spending across various industry verticals in the country and highlights key technology preferences among industry verticals, including cloud and artificial intelligence.

The Swiss ICT market is segmented by type (hardware, software, it services, and telecommunication services), size of enterprise (small and medium enterprise, large enterprise), and end-user vertical (BFSI, it and telecom, government, retail and e-commerce, manufacturing, energy and utilities, and other end-user verticals). The report provides the market sizes and forecasts in terms of value (USD).

| By Type | Hardware |

| Software | |

| IT Services | |

| Telecommunication Services | |

| By Size of Enterprise | Small and Medium Enterprises |

| Large Enterprises | |

| By Industry Vertical | BFSI |

| IT and Telecom | |

| Government | |

| Retail and E-commerce | |

| Manufacturing | |

| Energy and Utilities | |

| Other Industry Verticals |

| Hardware |

| Software |

| IT Services |

| Telecommunication Services |

| Small and Medium Enterprises |

| Large Enterprises |

| BFSI |

| IT and Telecom |

| Government |

| Retail and E-commerce |

| Manufacturing |

| Energy and Utilities |

| Other Industry Verticals |

Switzerland ICT Market Research FAQs

How big is the Switzerland ICT Market?

The Switzerland ICT Market size is expected to reach USD 129.27 billion in 2025 and grow at a CAGR of 8.96% to reach USD 198.53 billion by 2030.

What is the current Switzerland ICT Market size?

In 2025, the Switzerland ICT Market size is expected to reach USD 129.27 billion.

Who are the key players in Switzerland ICT Market?

Microsoft Corporation, IBM, Swisscom, Google LLC and Adnovum are the major companies operating in the Switzerland ICT Market.

What years does this Switzerland ICT Market cover, and what was the market size in 2024?

In 2024, the Switzerland ICT Market size was estimated at USD 117.69 billion. The report covers the Switzerland ICT Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Switzerland ICT Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Switzerland ICT Industry Report

Statistics for the 2025 Switzerland ICT market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Switzerland ICT analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.