Hospital Beds Market Size and Share

Hospital Beds Market Analysis by Mordor Intelligence

The hospital beds market is valued at USD 4.8 billion in 2025 and is forecast to reach USD 6.74 billion by 2030, advancing at a 6.99% CAGR. Rising investment in healthcare infrastructure, digital transformation of care delivery, and the integration of smart-bed functionalities are positioning the hospital beds market for steady, demand-led expansion. Hospitals are replacing legacy assets with connected platforms that capture clinical data, automate positioning, and support infection-control protocols, a trend amplified by higher occupancy rates and workforce shortages. Electric and semi-electric configurations are displacing manual beds as providers prioritize staff efficiency, while demographic ageing and chronic-disease prevalence are boosting long-term and home-care demand. Competitive intensity is increasing as leading manufacturers embed IoT, AI, and interoperability features that align with value-based care incentives and reimbursement structures.

Key Report Takeaways

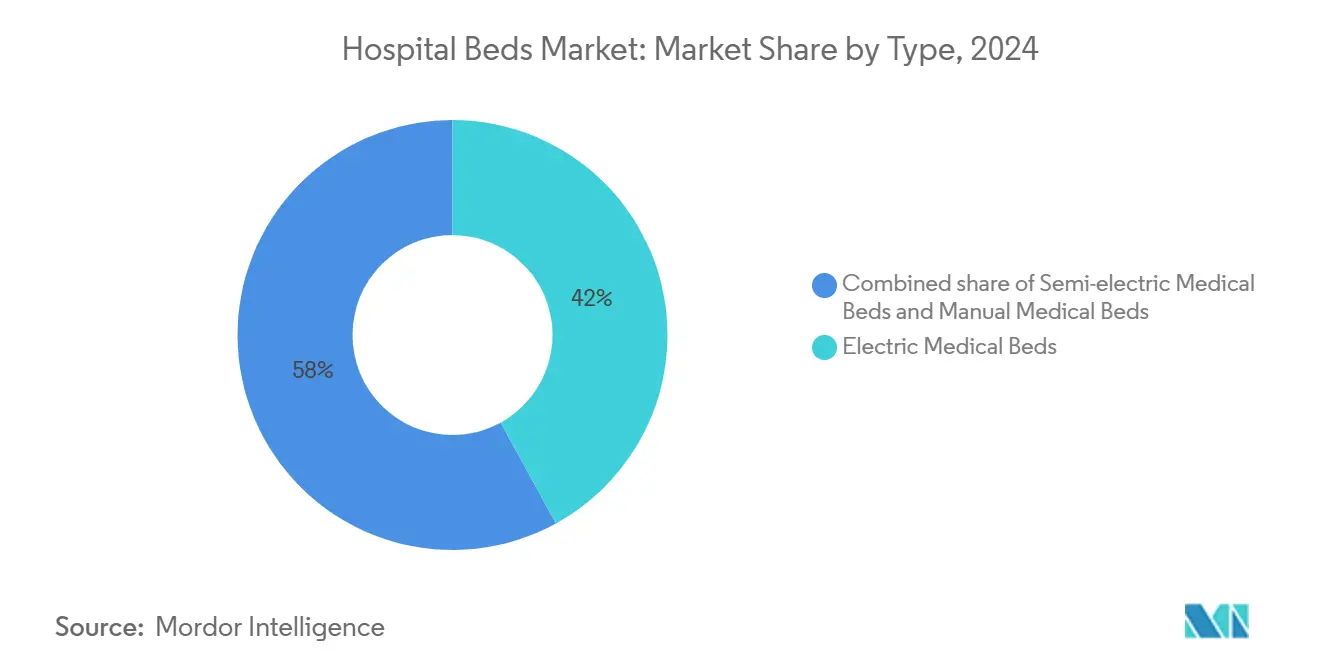

- By product type, Electric Medical Beds led with 42.0% revenue share in 2024, while Semi-electric Medical Beds are projected to expand at a 7.3% CAGR through 2030.

- By usage, Acute Care commanded 33.1% of the hospital beds market share in 2024, but Long-term Care is forecast to grow at an 8% CAGR to 2030.

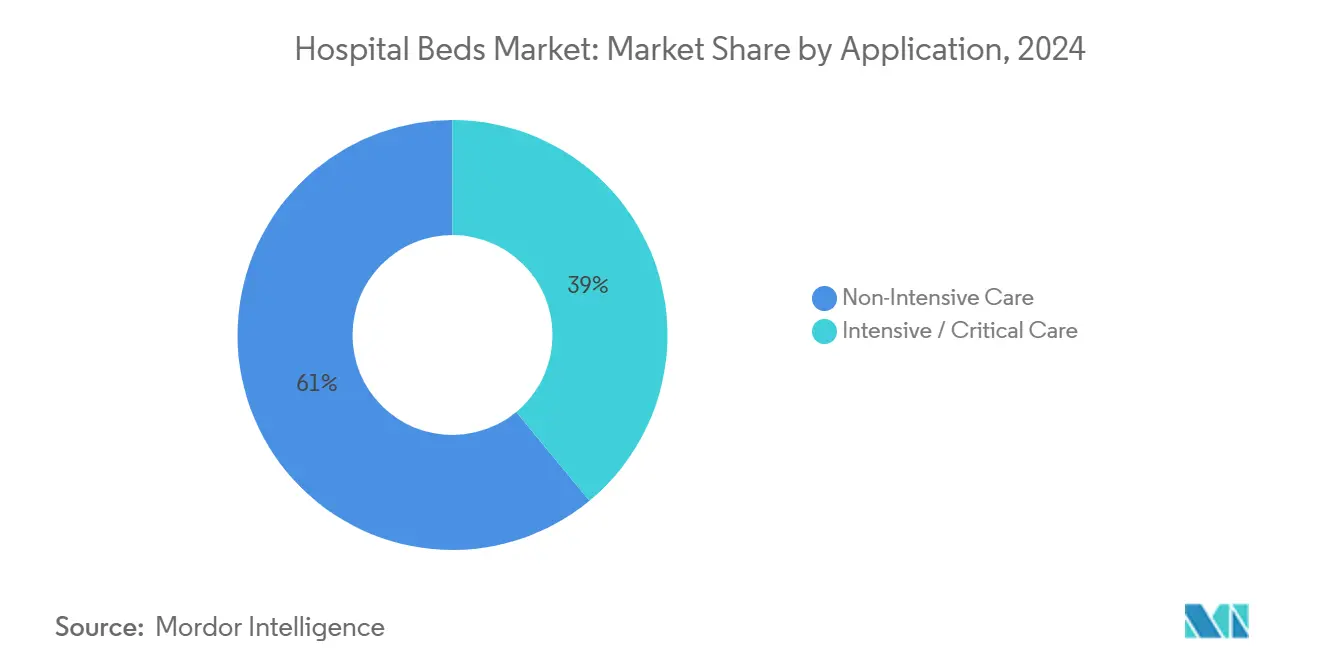

- By application, Non-Intensive Care accounted for 61.0% of the hospital beds market size in 2024; Intensive/Critical Care is advancing at a 5.7% CAGR through 2030.

- By end user, hospitals retained 50.8% of overall revenue in 2024, whereas the Home Healthcare segment is growing fastest at a 6.8% CAGR to 2030.

- By geography, Europe held a 30.0% share of the hospital beds market in 2024; Asia Pacific is set to rise at an 8.1% CAGR over 2025-2030.

Global Hospital Beds Market Trends and Insights

Driver Impact Analysis

| Drivers Impact Analysis | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Ageing population & chronic-disease burden | +1.8% | Europe, North America | Long term (≥ 4 years) |

| Global capacity-expansion projects | +1.5% | Asia Pacific, Middle East & Africa | Medium term (2-4 years) |

| Shift toward electric & smart beds | +1.4% | North America, Europe | Medium term (2-4 years) |

| Value-based care & infection-control focus | +1.2% | North America, Europe | Short term (≤ 2 years) |

| Rising demand for home & long-term care fueling specialty bed adoption | +1.3% | North America, Europe, Asia Pacific | Long term (≥ 4 years) |

| Government funding & pandemic preparedness investments in critical-care capacity | +1.0% | North America, Asia Pacific | Medium term (2-4 years) |

Source: Mordor Intelligence

Growing Geriatric & Chronic-Disease Population Driving Bed Demand

Adults aged 65+ are projected to reach 81 million in the United States by 2040, intensifying demand for beds equipped with pressure-injury prevention and fall-mitigation features. A 2024 Frontiers in Public Health study linked higher GDP and targeted healthcare spending with greater bed availability for older adults, emphasizing economic drivers behind this demographic pull. Hospitals are specifying therapeutic surfaces, integrated mobility aids, and continuous vital-sign monitoring to improve clinical outcomes for frail patients. Manufacturers are responding with segmented product lines that address bariatric, dementia, and palliative-care needs. The resulting premium subsegment is expanding faster than the overall hospital beds market as providers quantify the cost savings of reduced complications.

Expanding Healthcare Infrastructure & Capacity-Addition Projects Globally

Large-scale buildouts in emerging economies are bolstering baseline demand. Morocco’s plan to add 6,600 beds across regional and university facilities illustrates how government-funded projects create step-change volume[1]International Trade Administration, “Morocco – Healthcare,” trade.gov. Simultaneously, occupancy in U.S. hospitals could reach 85% by 2032, underscoring parallel needs for physical expansion and throughput efficiency. Infrastructure programs increasingly specify modular bed platforms that can be upgraded to higher acuity without structural change, stimulating a refresh cycle in mature markets and green-field demand in developing regions.

Technological Evolution Toward Electric & Smart Beds Enhancing Outcomes

Electric beds have become connectivity hubs that link patient-generated data to electronic records, automate lateral turns, and trigger nurse call alerts when fall risk rises. A deep-learning-enabled prototype recorded a 95% true-positive rate in detecting patient discomfort, demonstrating how sensors and algorithms reduce adverse events. Hospitals prioritize such features despite premium pricing because they lower total cost of care by shortening length of stay and avoiding pressure injuries. Vendors that offer over-the-air software updates and open APIs enjoy competitive advantage as interoperability becomes a purchasing criterion.

Shift To Value-Based Care And Heightened Infection-Control Standards

Payment models that penalize hospital-acquired conditions accelerate replacement of legacy assets. Hillrom’s Progressa+ ICU bed targets pressure-injury reduction, aligning with reimbursement for quality metrics[2]Indiana Business Journal, “Made in Indiana: Hospital Beds by Hill-Rom Holdings Inc.,” ibj.com. Stryker reported a 91.7% decline in such injuries with its ProCuity ZMX platform, quantifying ROI for smart surfaces[3]Stryker Corporation, “ProCuity ZMX,” stryker.com. Post-pandemic infection-control protocols emphasize seamless surfaces, antimicrobial coatings, and easy-cleaning designs, effectively transforming these attributes into procurement must-haves.

Restraints Impact Analysis

| Restraints Impact Analysis | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High capital cost in LMICs | -1.3% | Africa, South Asia | Medium term (2-4 years) |

| Regulatory & reimbursement hurdles | -1.1% | United States, European Union | Short term (≤ 2 years) |

| Dominant vendor contracts limiting competitive pricing | -0.9% | North America, Europe | Medium term (2-4 years) |

| Skilled nursing & caregiver shortages reducing utilization of advanced features | -0.8% | Europe, North America | Long term (≥ 4 years) |

Source: Mordor Intelligence

High capital cost & budget constraints in low-middle income markets

Construction costs approached USD 4 million per replacement bed in 2024, putting pressure on capital budgets and narrowing adoption to essential units. Hospitals in Oregon illustrate the strain, with 70% recording negative or minimal margins, forcing longer replacement cycles and selective upgrades[4]Oregon Association of Hospitals and Health Systems, “Oregon Hospitals on the Brink,” oregonhospitals.org. Financial constraints are prompting a tiered market where premium, feature-rich beds cluster in tertiary centers, while basic models dominate secondary facilities.

Stringent Regulatory & Reimbursement Hurdles Affecting Procurement Cycles

Diverse coverage rules across Medicare, Medicaid, and commercial plans complicate ROI calculations, elongating purchasing decisions. The FY 2025 IPPS proposed rule, with only a 2.6% operating-rate uplift, compresses capital budgets even as compliance standards tighten. Smaller manufacturers face disproportionate costs to certify electrical safety, cybersecurity, and interoperability, accelerating consolidation in the hospital beds market.

Segment Analysis

By Type: Electric Beds Spearhead Connected-Care Transformation

Electric Medical Beds captured 42.0% of the hospital beds market in 2024, anchored by automated positioning, load-bearing sensors, and EMR integration that align with quality-improvement mandates. This subsegment is forecast to enlarge its hospital beds market size as hospitals standardize around platforms that collect actionable data at the bedside. Semi-electric models, balancing affordability with servo-motors for head and foot articulation, are projected to expand at a 7.3% CAGR, appealing to mid-tier facilities upgrading from manual frames. Manual beds retain relevance in disaster relief and field hospitals where power reliability is limited, yet their share is tapering as total cost-of-ownership analyses favor electrified options.

Across all configurations, vendors are embedding Bluetooth and Wi-Fi modules that push firmware updates and enable predictive-maintenance alerts, translating into lower downtime and labor burden. A 2024 pilot showed that smart-bed telemetry reduced unscheduled maintenance by 28%, prolonging asset life. Manufacturers that bundle subscription software for positioning analytics are unlocking recurring revenue, differentiating themselves within a competitive hospital beds market.

The hospital beds market share is also influenced by form-factor evolution, including low-height frames that lower fall risk to older adults and bariatric variants rated for 500 kg. New materials such as magnesium-alloy side rails and antimicrobial powder coatings satisfy infection-control protocols while trimming weight, further enhancing ease of transport. As these technologies mature, cost curves are flattening, facilitating diffusion into secondary hospitals and driving incremental volumes for the hospital beds market.

By Usage: Long-Term Care Beds Outpace Acute-Care Replacements

Long-term Care beds are forecast to grow at an 8.0% CAGR, reflecting the clinical complexities of multimorbidity in ageing populations. Providers of skilled-nursing and rehabilitation services demand low-shear mattresses, auto-weight detection for accurate micro-turning, and integrated patient-entertainment consoles to improve satisfaction scores. The hospital beds market size for this usage is swelling as payers incentivize post-acute settings that shorten expensive inpatient stays.

Acute Care retained 33.1% of revenue in 2024 owing to the rotational replacement cycle of high-wear equipment in surgical and medical-surgical units. Hospitals are specifying multi-acuity beds that shift from med-surg to step-down care by swapping out surface modules, optimizing fleet utilization. Maternity and pediatric sub-segments require niche designs, including adjustable labor-delivery-recovery units and cribs with built-in pulse-oximetry, generating specialized demand pockets.

Home-care adoption of semi-electric portable frames with aesthetic wood panels is rising as hospitals discharge patients earlier to manage capacity. Bed-as-a-service rental models are emerging, wherein suppliers handle maintenance and remote monitoring, easing caregiver burden and creating an ancillary revenue stream within the hospital beds market.

By Application: Non-Intensive Care Dominates Volume but Critical-Care Beds Capture Value

Non-Intensive Care represented 61% of 2024 shipments, supported by general-ward refurbishment programs that prioritize fall-prevention alarms and one-button CPR positions. Cost-optimized smart beds that integrate basic sensors without the full ICU feature stack are gaining traction as providers weigh ROI against tight budgets. The hospital beds market share for general-ward beds is expected to remain stable, yet unit revenue may decline as component costs fall.

Intensive/Critical Care beds, conversely, command premium pricing due to integrated ventilator interfaces, percussion therapy, and lateral rotation. Tele-ICU connectivity enables off-site intensivists to monitor trends, contributing to shorter length of stay and higher throughput. A projected 5.7% CAGR is underpinned by pandemic-driven resiliency plans that require flexible conversion of operating rooms into temporary ICUs.

As health systems adopt acuity-adjustable care models, beds capable of modular reconfiguration are in demand, blurring application boundaries. This trend propels cross-training of nursing staff and simplifies logistics, enhancing capacity utilization within the hospital beds market size.

By End User: Hospitals Remain Core Buyers While Home Healthcare Surges

Hospitals controlled 50.8% of revenue in 2024, focusing upgrades on beds that streamline workflows amid staffing shortages. Voice-activated nurse-call modules and automatic egress detection reduce response times and align with quality metrics. Integration with real-time location systems (RTLS) enables asset-tracking and patient-flow analytics, supporting command-center operations.

The Home Healthcare sub-segment is expanding at a 6.8% CAGR as payers endorse hospital-at-home models. Systems such as Mass General Brigham’s target 70 virtual beds, underlining how decentralized acute-care delivery is reshaping procurement criteria toward lightweight frames, tool-less assembly, and consumer-grade design aesthetics. Ambulatory Surgical Centers prefer short-stay recovery couches with integrated transfer boards to quicken discharge; manufacturers tailor these with wipe-clean upholstery and collapsible footprints for space efficiency.

In long-term and rehabilitation facilities, investment hinges on durable frames with 10-year service lives and low total cost of ownership, encouraging multi-year supply contracts that lock in pricing and service agreements within the hospital beds market.

Geography Analysis

Europe accounted for 30.0% of global revenue in 2024, anchored by stringent clinical standards, an ageing demographic, and replacement-driven demand in Germany, France, and the United Kingdom. Bed density varies widely, with Germany maintaining 766 beds per 100,000 population, reflecting historic capacity investments ec.europa.eu. Eastern European systems are modernizing to align with EU infection-control guidelines, driving adoption of low-height electrified frames. Scandinavian countries focus on ergonomic designs to mitigate staff musculoskeletal injuries, furthering demand for height-adjustable platforms in the hospital beds market.

Asia Pacific is projected to register an 8.1% CAGR over 2025-2030, propelled by infrastructure build-outs and policy initiatives that expand universal coverage. Japan leads in premium smart-beds adoption, while China’s provincial build plans emphasize volume procurement to boost baseline density. India’s Ayushman Bharat program is stimulating demand in tier-2 cities, though budget constraints favor semi-electric imports. Start-ups in Singapore and South Korea are commercializing AI-embedded beds targeting regional export markets, supporting technology diffusion across ASEAN. The hospital beds market size in Asia Pacific is additionally benefiting from rising home-care adoption as families seek ageing-in-place solutions amid limited long-term-care facilities.

North America remains the innovation nucleus, with U.S. providers prioritizing beds that support predictive analytics and nurse workflow automation. Occupancy is forecast to climb despite ambulatory-shift trends, sustaining replacement cycles. Canada invests in long-term-care modernization, upgrading facilities with bariatric-rated and pressure-redistribution surfaces. Meanwhile, Middle East & Africa and South America are scaling tertiary centers in urban hubs while grappling with rural shortfalls; Gulf states procure premium ICU platforms for flagship hospitals, whereas Latin American markets favor cost-competitive semi-electric models, creating tiered pricing opportunities within the hospital beds market.

Competitive Landscape

The top five suppliers— Baxter International (Hillrom), Stryker Corporation, LINET Group SE, Paramount Bed Co. Ltd., and ARJO—collectively hold roughly 60.0% share, yielding a moderately concentrated structure that rewards scale and R&D muscle. Leading firms invest heavily in sensor fusion, cybersecurity, and cloud interoperability, positioning themselves as digital-platform providers rather than furniture vendors. Stryker’s 2024 acquisition of care.ai strengthened its autonomous monitoring portfolio, integrating computer-vision fall-detection with bed units to alleviate nurse staffing constraints.

Baxter’s Voalte Linq voice-activated wearable extends the bed ecosystem, enabling hands-free communication and real-time alarm routing, thereby improving care-team collaboration. LINET emphasizes ergonomic engineering and offers an open API for third-party integration, aligning with hospital IT convergence strategies. Regional champions such as China’s Kangmei and India’s Midmark target value segments with semi-electric ranges while launching pilot smart-bed lines, intensifying price competition in emerging markets.

Strategic alliances with mattress suppliers, software vendors, and telehealth platforms are becoming critical differentiators. Subscription models that bundle analytics dashboards, remote diagnostics, and preventative maintenance deliver predictability for hospital budgets and recurring revenue for manufacturers. However, rising raw-material and electronics costs pressure margins, prompting players to localize supply chains and introduce modular designs that share components across product families, reinforcing competitiveness within the hospital beds market.

Hospital Beds Industry Leaders

-

Baxter International (Hillrom)

-

Stryker Corporation

-

LINET Group SE

-

Paramount Bed Co. Ltd.

-

ARJO

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- March 2025: Baxter International reported Q1 2025 sales of USD 2.63 billion, lifted by patient support systems.

- February 2025: Agiliti introduced Essentia™, a multi-acuity bed with SlideRail™ mobility aid and 11.5-inch deck-height target.

- February 2025: Baxter announced FY 2024 revenue of USD 10.64 billion after divesting its kidney-care unit to focus on core medical products.

- February 2025: Stryker acquired Inari Medical for USD 4.9 billion, expanding device synergies.

- December 2024: Baxter Pluvinger facility received the Shingo Prize for operational excellence in manufacturing smart beds.

- August 2024: Stryker bought care.ai, integrating autonomous monitoring into bed platforms.

Global Hospital Beds Market Report Scope

As per the scope of the report, medical beds are hospital equipment intended for bedridden patients or patients who need care. Medical beds allow better positioning of patients, ease the transfer, and prevent the risk of falling out of bed. The medical beds market is segmented by type, usage, application, end user, and geography. By type, the market is segmented into electric medical beds, semi-electric medical beds, and manual medical beds. By usage, the market is segmented into long-term care, acute care, maternity, and other usages. By application, the market is segmented into non-intensive care and intensive care. By end user, the market is segmented into hospitals, home care, and other end users. By geography, the market is segmented into North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. For each segment, the market sizing and forecasts are made based on value (in USD).

| By Type | Electric Medical Beds | ||

| Semi-electric Medical Beds | |||

| Manual Medical Beds | |||

| By Usage | Longterm Care | ||

| Acute Care | |||

| Maternity | |||

| Other Usages | |||

| By Application | Non-Intensive Care | ||

| Intensive / Critical Care | |||

| By End User | Hospitals | ||

| Home Healthcare | |||

| Ambulatory Surgical Centers | |||

| Other End Users | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| South Korea | |||

| Rest of Asia Pacific | |||

| Middle East & Africa | GCC | ||

| South Africa | |||

| Rest of Middle East & Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Electric Medical Beds |

| Semi-electric Medical Beds |

| Manual Medical Beds |

| Longterm Care |

| Acute Care |

| Maternity |

| Other Usages |

| Non-Intensive Care |

| Intensive / Critical Care |

| Hospitals |

| Home Healthcare |

| Ambulatory Surgical Centers |

| Other End Users |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia Pacific | China |

| Japan | |

| India | |

| Australia | |

| South Korea | |

| Rest of Asia Pacific | |

| Middle East & Africa | GCC |

| South Africa | |

| Rest of Middle East & Africa | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Key Questions Answered in the Report

What is the current value of the hospital beds market?

The hospital beds market is worth USD 4.81 billion in 2025 and is projected to grow to USD 6.74 billion by 2030.

Which product segment holds the largest hospital beds market share?

Electric Medical Beds led with 42.0% of revenue in 2024.

Why are smart beds gaining traction in hospitals?

Smart beds integrate sensors and connectivity that reduce pressure injuries, automate patient monitoring, and lower nursing workload, aligning with value-based care incentives.

Which region is expanding fastest in the hospital beds market?

Asia Pacific is forecast to grow at an 8.1% CAGR from 2025 to 2030 due to large-scale infrastructure investments and demographic ageing.

How are hospitals addressing budget constraints when upgrading beds?

Providers adopt semi-electric models for basic wards, negotiate subscription maintenance contracts, and prioritize high-acuity units for premium smart-bed deployment to balance cost and clinical benefit.

What impact will workforce shortages have on future bed demand?

With U.S. occupancy potentially rising to 85% by 2032, hospitals are investing in beds that automate repositioning and alarm escalation to offset staffing gaps and maximize existing capacity.