India Endoscopy Devices Market Analysis by Mordor Intelligence

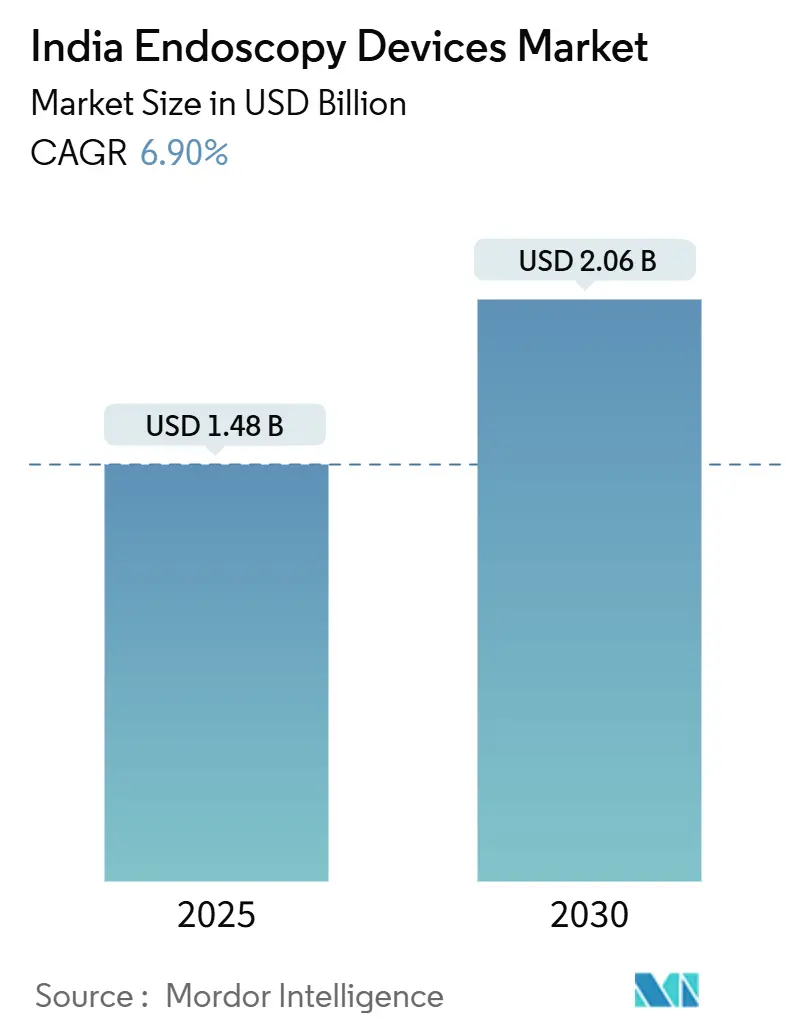

India endoscopy devices market stands at USD 1.48 billion in 2025 and is projected to reach USD 2.06 billion by 2030, advancing at a 6.9% CAGR. Growth is anchored in the rising burden of gastrointestinal cancers, government incentives that push local manufacturing, and rapid upgrades from standard-definition equipment to 4K and AI-enabled visualization. Domestic production strengthened by the Production-Linked Incentive (PLI) scheme is beginning to soften import dependence while lowering price points that once limited access outside metros. At the same time, day-care ambulatory surgical center (ASC) chains are spreading across tier-2 cities, adding fresh demand for mid-tier systems that balance performance and cost. Although reusable scopes still dominate, single-use devices are gaining traction as hospitals respond to stricter infection-control norms established in the post-COVID era.

Key Report Takeaways

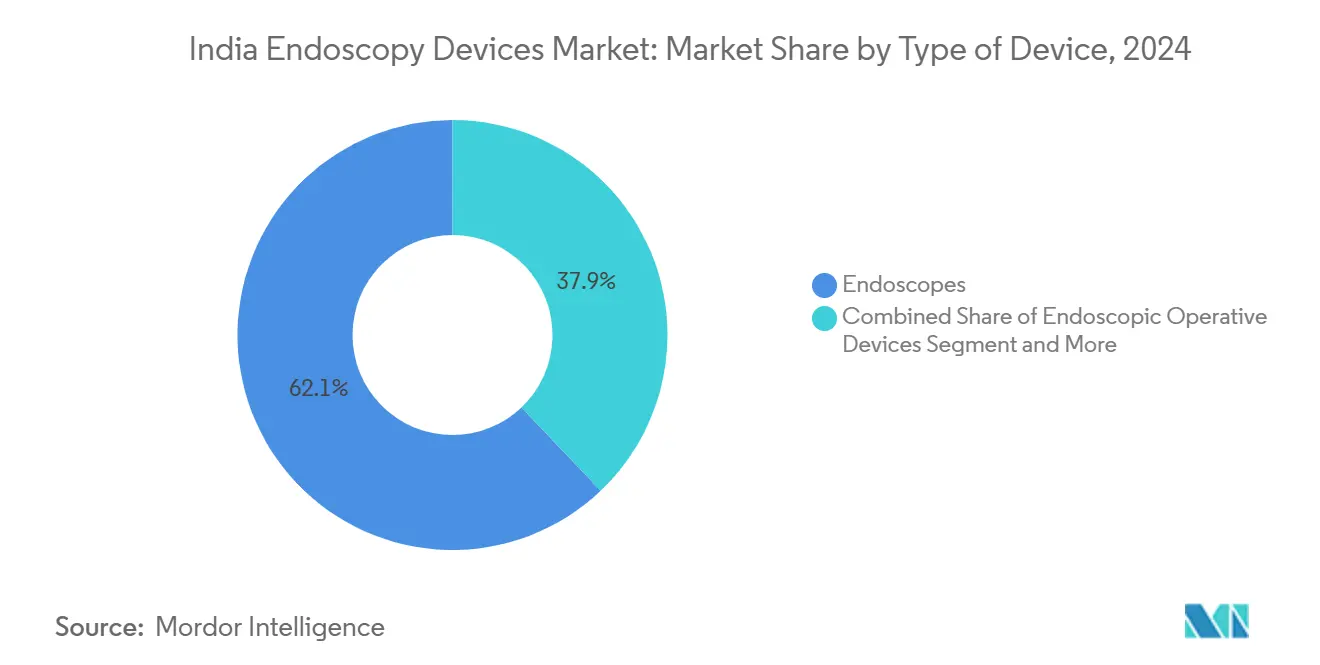

- By device type: endoscopes led with 62.13% of India endoscopy devices market share in 2024, while visualization equipment is forecast to expand at an 8.78% CAGR through 2030.

- By application: gastroenterology accounted for 44.63% of India endoscopy devices market size in 2024; ENT surgery is the fastest-growing application with a 9.23% CAGR to 2030.

- By end-user: hospitals held 68.65% share of the India endoscopy devices market in 2024, whereas ASCs are set to rise at an 8.24% CAGR during the forecast period.

- By usage pattern: reusable devices commanded 83.69% share of the India endoscopy devices market size in 2024, yet single-use scopes are advancing at an 8.82% CAGR.

India Endoscopy Devices Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising burden of gastrointestinal cancers & disorders | +1.8% | National; higher in North East, Kerala | Medium term (2-4 years) |

| Government PLI scheme catalysing domestic manufacturing | +1.2% | National; hubs in Karnataka, Tamil Nadu, Gujarat | Long term (≥ 4 years) |

| Rapid penetration of day-care ASC chains across tier-2 cities | +0.9% | Tier-2 cities in Maharashtra, Karnataka, Tamil Nadu, Gujarat | Short term (≤ 2 years) |

| Integration of AI-assisted CADx modules | +0.7% | Metro hospitals & early adopters | Medium term (2-4 years) |

| Post-COVID backlog of elective endoscopic procedures | +0.6% | Urban hospitals & ASCs nationwide | Short term (≤ 2 years) |

| Expanding private health-insurance coverage | +0.5% | Urban & semi-urban middle-class clusters | Medium term (2-4 years) |

Source: Mordor Intelligence

Rising Burden of Gastrointestinal Cancers & Disorders

Incidence of gastrointestinal cancers is projected to climb from 1.41 million cases in 2022 to 2.2 million by 2040, increasing procedural volumes for the India endoscopy devices market[1]Shashank Bansal, “Snowflake Model: Redefining and Optimizing the Cancer Care Delivery System in Tier 2 and Tier 3 Cities in India,” JCO Global Oncology, ascopubs.org. North-East India records notably higher gastric and esophageal cancer rates, magnifying regional demand for early-stage detection platforms. Early gastric cancer detection sits at 0.6% in prospective screening studies, suggesting a large diagnostic gap that flexible and capsule endoscopy can help close. Indian tertiary centers now report en-bloc resection rates above 90% when using endoscopic submucosal dissection, but diffusion beyond metros is constrained by skills shortages and infrastructure gaps. Collectively, these factors accelerate uptake of high-definition and AI-enabled visualization systems that lift detection sensitivity.

Government PLI Scheme Catalysing Domestic Manufacturing

The PLI program aims to lift India’s medical-device output, granting tax breaks and subsidies to local factories[2]Department of Pharmaceuticals, “Boosting the Indian Medical Devices Industry,” Government of India, pharma-dept.gov.in. Device makers such as BPL MedTech have already opened second plants in Bengaluru, adding capacity for endoscopy consoles and accessories. Local sourcing trims delivery lead-times for hospitals in tier-2 cities, broadens service networks, and compresses average selling prices, boosting unit demand. The 2023 National Medical Devices Policy further simplifies product registration, encouraging both multinationals and domestic players to site R&D hubs in India. Over time, these incentives should raise the India endoscopy devices market’s self-reliance ratio and export capability.

Rapid Penetration of Day-Care ASC Chains Across Tier-2 Cities

India’s “Snowflake Model” of decentralized cancer care places ASCs at the center of early-diagnosis pathways and is reshaping utilization patterns. Private chains are standardizing workflows, sourcing mid-tier towers that deliver 4K image clarity without the cost burden of flagship systems. Maharashtra alone is funding 36 Integrated Public Health Labs and Critical Care Blocks, ensuring procedure back-up for ASC networks. As payment models shift to bundled packages under Ayushman Bharat and private insurance, operators prefer quick-turn devices that minimize downtime and reprocessing complexity, supporting growth in flexible scopes with disposable sheaths.

Integration of AI-Assisted CADx Modules

Metro endoscopy suites are piloting AI overlays that boost lesion-detection accuracy to 86-92% versus standard practice. Odisha’s public–private partnership launched India’s first AI-powered GI endoscopy center, demonstrating real-time polyp-flagging on conventional towers. Surveys show 83% of Asian gastroenterologists are ready to adopt CADe modules, but challenges include data-security compliance and clinician training. Regulatory bodies now draft cybersecurity norms aligned with global best practice, helping hospitals manage networked-device risk. As confidence grows, vendors bundle AI software with mid-range consoles, increasing total value without proportionate hardware cost hikes—an attractive proposition for the India endoscopy devices market.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Shortage of trained endoscopy technicians | -1.1% | National; acute in rural & tier-3 cities | Long term (≥ 4 years) |

| High capital & maintenance cost of advanced systems | -0.8% | Tier-2/3 facilities | Medium term (2-4 years) |

| Limited public-sector reimbursement for therapeutics | -0.6% | Government hospitals | Long term (≥ 4 years) |

| Cyber-security risk for networked video systems | -0.4% | Tech-enabled urban hospitals | Short term (≤ 2 years) |

Source: Mordor Intelligence

Shortage of Trained Endoscopy Technicians

India has no unified curriculum for GI technicians, and professional societies warn that uneven skill levels restrict adoption of complex procedures. Rural districts feel the squeeze most, with late-stage cancer prevalence still topping 80% of presentations. National task forces propose a three-tier certification ladder, yet funding for simulation labs remains sparse. Premier centers in Mumbai and Hyderabad now run train-the-trainer courses that eventually cascade skills into peripheral hospitals, but near-term staffing gaps persist and temper the pace at which advanced platforms penetrate the India endoscopy devices market.

High Capital & Maintenance Cost of Advanced Systems

Hospitals outside metros weigh 4K or 3D consoles against budget ceilings, often delaying upgrades until procedures volumes guarantee payback. Even when flagship towers are acquired, service contracts and proprietary spares add recurring costs that smaller facilities struggle to absorb. Although Ayushman Bharat covers patient expenses, provider reimbursements rarely reflect the true cost of AI modules or robotic peripherals, capping purchasing appetite. Consequently, manufacturers have begun positioning mid-range towers bundled with scaled-down AI as a pragmatic bridge for cost-sensitive buyers.

Segment Analysis

By Type of Device: Visualization Equipment Drives Innovation

Endoscopes generated 62.13% of India endoscopy devices market revenue in 2024 by virtue of their essential diagnostic role across GI, respiratory, and surgical specialties. Flexible scopes dominate, while capsule units are opening non-invasive pathways in small-bowel imaging. Over the forecast window, visualization equipment is set to register an 8.78% CAGR, outpacing hardware growth as hospitals upgrade to 4K, 3D, and ultrasound-endoscopy towers. The India endoscopy devices market size for visualization is projected to widen further as AI software licenses are increasingly bundled with image processors, elevating console value without physical footprint expansion.

Growth in disposable endoscope volumes is propelled by infection-control mandates, even though environmental debates linger. Manufacturers now trial bio-derived plastics and recycling partnerships to neutralize sustainability pushback. Robot-assisted platforms remain niche today, but as patents expire and local engineering talent matures, capital prices are expected to fall, inviting broader uptake among high-volume cancer centers.

Note: Segment shares of all individual segments available upon report purchase

By Application: ENT Surgery Outpaces Traditional Gastroenterology

Gastroenterology continues to anchor 44.63% of India endoscopy devices market share thanks to ongoing colorectal and gastric cancer screening campaigns. Nonetheless, ENT surgery displays the fastest momentum, expanding 9.23% annually as sinus, laryngeal, and skull-base procedures pivot to minimally invasive optics. Pulmonology follows closely, driven by bronchoscopy’s rising role in lung-cancer staging and therapeutic tumor ablation. Together, these trends underscore a gradual pivot from purely diagnostic GI scopes toward cross-specialty, therapy-oriented devices within the India endoscopy devices market.

Migrating ENT, gynecology, and urology procedures to endoscopic workflows also shifts device ergonomics demands: slimmer diameters, articulating tips, and specialty accessory channels all spur product redesigns. Bariatric and orthopedic interventions further widen the opportunity landscape, positioning multi-modality towers as a cost-effective foundation for diverse departments.

By End-User: ASC Growth Challenges Hospital Dominance

Hospitals capture 68.65% of India endoscopy devices market spending owing to legacy infrastructure, oncology programs, and academic referral networks. Yet ASCs are scaling fastest at 8.24% CAGR as private equity finances chain rollouts in fast-growing regional cities. The India endoscopy devices market size attributable to ASCs will therefore expand rapidly, underpinned by patient preference for shorter stays and transparent pricing.

Specialty clinics and diagnostic centers round out end-user demand, providing lower-acuity settings for screening workups. Vendors increasingly offer compact towers and subscription-based service plans tailored to these sites, supporting distributed adoption while keeping capital commitments manageable.

Note: Segment shares of all individual segments available upon report purchase

By Usage: Single-Use Adoption Accelerates Despite Sustainability Concerns

Reusable scopes still held 83.69% of India endoscopy devices market size in 2024 after decades of entrenched workflows and central-sterile investments. However, single-use scopes are rising 8.82% annually, propelled by heightened scrutiny of device-borne infections and the logistical relief of eliminating reprocessing. Policymakers cite data showing endoscope-linked events constitute 7.7% of medical-device hazards, reinforcing adoption. Yet hospitals remain cautious about waste volumes; a typical GI procedure generates 1.34 kg of disposables, pushing providers to pilot recycling initiatives and life-cycle assessments before wholesale migration.

Geography Analysis

Southern states form the technology vanguard of the India endoscopy devices market, with Karnataka, Tamil Nadu, and Kerala accounting for a disproportionate share of premium system installations. Bengaluru’s med-tech corridor hosts both multinational service hubs and domestic manufacturing plants, supplying quick-turn maintenance that clinicians value. Tamil Nadu’s insurance scheme expands device throughput by covering diagnostic endoscopy for low-income groups, while Kerala’s robust primary-care network funnels patients toward early screening centers equipped with HD towers.

Western India—led by Maharashtra and Gujarat—exhibits rapid volume gains as industrial affluence lifts private-care spending. Gujarat also benefits from state-level manufacturing parks that lower logistics costs for local distributors, reinforcing self-supply and exports throughout South Asia. The India endoscopy devices market in this region enjoys healthy replacement cycles: tertiary hospitals steadily swap legacy analog towers for 4K platforms to stay referral-competitive.

North-East India presents the starkest unmet need. Gastric-cancer incidence rates far exceed the national mean, yet clinical capacity remains sparse. Government cancer-care outposts and philanthropic initiatives are therefore funneling grant money toward modular endoscopy suites that can be deployed inside district hospitals. Across all regions, tier-2 and tier-3 cities are the fastest-growing catchments for the India endoscopy devices market, tapping PLI-backed local manufacturing and PM-ABHIM infrastructure funding to procure mid-tier systems at favorable price points.

Competitive Landscape

The India endoscopy devices market displays moderate concentration: global majors retain the upper hand in premium systems while domestic firms encroach on mid-tier niches. Olympus continues to dominate GI scopes worldwide and has ramped Indian training centers to lock in customer loyalty[3]Olympus Corporation, “Integrated Report 2024,” Olympus-global.com. Pentax and Fujifilm compete through bundled service contracts, whereas Karl Storz leverages its multispecialty optics to secure ENT and urology tenders.

Local manufacturers—backed by PLI subsidies—now produce entry-level flexible scopes and accessories at 20–25% lower landed cost. BPL MedTech’s new Bengaluru plant highlights this shift and signals intent to carve share in visualization consoles. Start-ups focusing on AI algorithms further challenge incumbents by offering software-only upgrades that slot onto existing towers, nudging hardware makers into partnerships.

Robotic and 3D imaging platforms represent a future battleground. As global patents lapse, Indian engineering firms are prototyping domestic robot-assisted scopes aimed at price-sensitive oncology clinics. Multinationals answer with training grants and service hubs to preserve high-margin segments. Cyber-security, meanwhile, is turning into a differentiator: vendors able to certify end-to-end network safety stand to win hospital trust as device fleets go online.

India Endoscopy Devices Industry Leaders

-

Medtronic PLC

-

Olympus Corporation

-

Stryker Corporation

-

Karl Storz SE & Co. KG

-

Boston Scientific Corporation

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- October 2024: BPL MedTech inaugurated its second manufacturing facility in Bengaluru, expanding production capacity for endoscopy consoles and accessories.

- January 2024: Odisha launched India’s first AI-powered GI endoscopy program through a partnership between Omega Healthcare and Sanjivani Gastro Liver Clinic.

India Endoscopy Devices Market Report Scope

As per the scope of the report, endoscopy is a device used in medicine to look inside the body. The endoscopy procedure uses an endoscope to examine the interior of a hollow organ or cavity of the body. Unlike many other medical imaging techniques, endoscopes are inserted directly into the organ. The Indian endoscopy devices market is segmented by type of device (endoscopes (rigid endoscope, flexible endoscopes, and other endoscopes), endoscopic operative device, and visualization equipment (endoscopic camera, SD visualization system, and HD visualization system)), and application (gastroenterology, pulmonology, orthopedic surgery, cardiology, ENT surgery, gynecology, and other applications). The report offers the value (in USD million) for the above segments.

| By Type of Device | Endoscopes | Rigid Endoscope | |

| Flexible Endoscope | |||

| Capsule Endoscope | |||

| Robot-assisted Endoscope | |||

| Single-use/Disposable Endoscope | |||

| Endoscopic Operative Devices | Access Devices | ||

| Retrieval Devices | |||

| Insufflation Devices | |||

| Energy & Hemostasis Devices | |||

| Closure Devices | |||

| Visualization Equipment | Endoscopic Camera | ||

| SD Visualization System | |||

| HD Visualization System | |||

| 4K / 3D Visualization System | |||

| Ultrasound Endoscopy (EUS) Systems | |||

| By Application | Gastroenterology | ||

| Pulmonology | |||

| Orthopedic Surgery | |||

| Cardiology | |||

| ENT Surgery | |||

| Gynecology | |||

| Urology | |||

| Neurology | |||

| Bariatric Surgery | |||

| Other Applications | |||

| By End-User | Hospitals | ||

| Ambulatory Surgical Centers | |||

| Specialty Clinics | |||

| Diagnostic Imaging Centers | |||

| By Usage | Re-usable Devices | ||

| Single-use Devices | |||

| Endoscopes | Rigid Endoscope |

| Flexible Endoscope | |

| Capsule Endoscope | |

| Robot-assisted Endoscope | |

| Single-use/Disposable Endoscope | |

| Endoscopic Operative Devices | Access Devices |

| Retrieval Devices | |

| Insufflation Devices | |

| Energy & Hemostasis Devices | |

| Closure Devices | |

| Visualization Equipment | Endoscopic Camera |

| SD Visualization System | |

| HD Visualization System | |

| 4K / 3D Visualization System | |

| Ultrasound Endoscopy (EUS) Systems |

| Gastroenterology |

| Pulmonology |

| Orthopedic Surgery |

| Cardiology |

| ENT Surgery |

| Gynecology |

| Urology |

| Neurology |

| Bariatric Surgery |

| Other Applications |

| Hospitals |

| Ambulatory Surgical Centers |

| Specialty Clinics |

| Diagnostic Imaging Centers |

| Re-usable Devices |

| Single-use Devices |

Key Questions Answered in the Report

What is the current size of the India endoscopy devices market?

The India endoscopy devices market is valued at USD 1.48 billion in 2025.

How fast will the market grow through 2030?

It is projected to expand at a 6.9% CAGR, reaching USD 2.06 billion by 2030.

Which device segment is growing the quickest?

Visualization equipment—particularly 4K and AI-enabled processors—is forecast to post an 8.78% CAGR through 2030.

Why are ambulatory surgical centers important for market growth?

ASCs bring endoscopy services to tier-2 cities, delivering cost-efficient day-care procedures and fueling an 8.24% CAGR in device demand from this channel.

How is government policy influencing domestic production?

The PLI scheme offers tax incentives and grants that lower manufacturing costs, encouraging both multinational and Indian firms to build plants and reduce reliance on imports.

Are single-use endoscopes likely to overtake reusable models?

Single-use scopes are gaining traction at an 8.82% CAGR thanks to infection-control advantages, but sustainability concerns mean reusable models will still dominate the market over the forecast horizon.