Ophthalmic Drugs Market Size

Ophthalmic Drugs Market Analysis

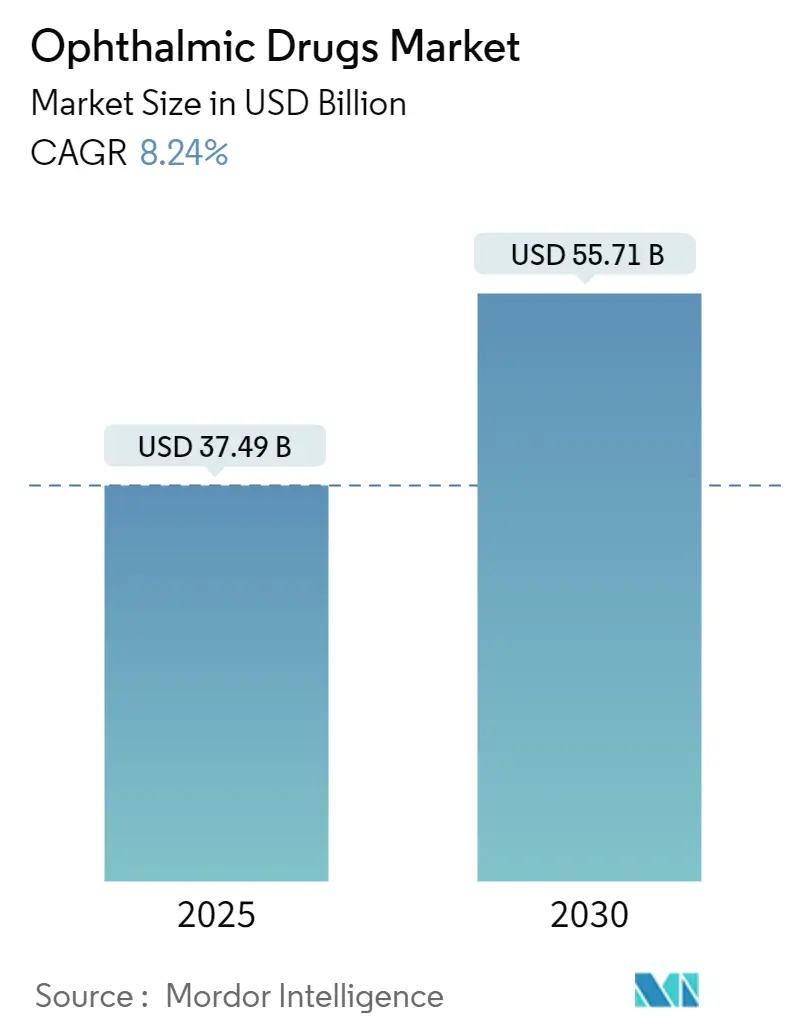

The Ophthalmic Drugs Market size is estimated at USD 37.49 billion in 2025, and is expected to reach USD 55.71 billion by 2030, at a CAGR of 8.24% during the forecast period (2025-2030).

The global ophthalmic drugs market is experiencing significant transformation driven by technological advancements in drug delivery systems and increasing healthcare expenditure worldwide. Advanced drug formulations, including preservative-free options and sustained-release technologies, are becoming increasingly prevalent in the market. The emergence of nanomicellar technology has particularly revolutionized drug delivery, improving the bioavailability and tissue penetration of ophthalmic medications. According to the World Health Organization's October 2022 data, approximately 2.2 billion people globally have vision impairment or blindness, highlighting the vast potential market for ophthalmic treatments.

The market landscape is witnessing a surge in biosimilar development and commercialization, particularly in developed regions. A notable example is the April 2023 launch of the ranibizumab biosimilar in European markets by Xbrane Biopharma AB and STADA Arzneimittel AG, offering cost-effective treatment options for various eye disorders. The industry is also seeing increased adoption of preservative-free formulations, responding to growing awareness of the potential adverse effects of preservatives in long-term ophthalmic medication use. This trend is evidenced by recent regulatory approvals, such as the March 2023 FDA acceptance of Novaliq's CyclASol, a first-of-its-kind preservative-free anti-inflammatory product.

The ophthalmic drugs market is experiencing substantial growth in emerging economies, driven by improving healthcare infrastructure and increasing access to eye care services. Market expansion is particularly notable in regions with a high prevalence of eye disorders, with WHO data from June 2022 indicating that 125 million people live in trachoma-endemic areas globally. Healthcare systems worldwide are increasingly focusing on preventive eye care, leading to earlier intervention and treatment of ocular conditions. This shift is supported by expanding insurance coverage for ophthalmic medicines and growing awareness of eye health among the general population.

The industry is witnessing significant consolidation through strategic partnerships and acquisitions, aimed at expanding product portfolios and geographical reach. Ophthalmic pharmaceutical companies are increasingly focusing on specialized therapeutic areas within ophthalmology, leading to more targeted treatment approaches. The market is also seeing a trend toward integrated eye care solutions, combining pharmaceutical treatments with diagnostic technologies and patient monitoring systems. Recent regulatory developments, such as Alembic Pharmaceuticals' March 2023 FDA approval for Brimonidine Tartrate Ophthalmic Solution, demonstrate the continued innovation in the sector. These strategic movements are reshaping competitive dynamics and driving innovation in treatment modalities.

Ophthalmic Drugs Market Trends

Increasing Incidence and Prevalence of Eye-Related Disorders

The growing burden of eye-related disorders globally has become a critical driver for the ophthalmic drugs market. According to the World Health Organization, as of October 2022, approximately 2.2 billion people worldwide have vision impairment or blindness, with at least 1 billion cases being preventable. The breakdown of these cases includes 123.7 million people with unresolved refractive error, 65.2 million with cataracts, 6.9 million with glaucoma, 4.2 million with corneal opacities, 3 million with diabetic retinopathy, and 2 million with trachoma. Additionally, there are 826 million cases of presbyopia-related vision impairment, highlighting the massive scale of eye health challenges globally.

The rising prevalence of specific eye conditions is further intensifying the demand for ophthalmic medications. For instance, according to the Centers for Disease Control and Prevention in November 2022, there are over 3 million cases of glaucoma recorded in the United States, with projections indicating an increase to 6.3 million by 2050. Similarly, trachoma, an eye disease caused by bacterial infection, affects approximately 125 million people who live in trachoma-endemic areas and are at risk of trachoma blindness, as reported by WHO in October 2022. These statistics underscore the growing need for effective ocular drugs and are driving pharmaceutical companies to expand their ophthalmic drug portfolios.

Rising Research and Development Pertaining to the Development of Novel Drugs

The ophthalmic drugs market is experiencing significant growth driven by intensive research and development activities focused on creating innovative therapeutic solutions. In 2023, several breakthrough developments have emerged, demonstrating the industry's commitment to advancing eye care treatments. For instance, in June 2023, the United States Food and Drug Administration (FDA) accepted the New Drug Application (NDA) for Novaliq's CyclASol (cyclosporine ophthalmic solution), representing a first-of-its-kind anti-inflammatory product for treating dry eye disease signs and symptoms. This innovation showcases the industry's progress in developing novel drug delivery mechanisms and formulations.

The pharmaceutical industry's dedication to research and development is further evidenced by recent strategic collaborations and regulatory milestones. In April 2023, Xbrane Biopharma AB and STADA Arzneimittel AG collaborated to launch a ranibizumab biosimilar in European markets, offering a cost-effective treatment option for various eye disorders, including wet age-related macular degeneration, diabetic macular edema, and diabetic retinopathy. Additionally, in March 2023, Aldeyra Therapeutics Inc. received FDA acceptance for Priority Review of their New Drug Application for ADX-2191, targeting primary retinal lymphoma. These developments demonstrate the industry's commitment to expanding the range of available treatments and improving patient outcomes through innovative drug development.

Increasing Focus on Developing Combination Therapies

The ophthalmic suspension market size is witnessing a significant shift toward combination therapies, which offer enhanced therapeutic outcomes compared to single-drug treatments. According to the Regulatory Affairs Professionals Society's January 2023 report on FDA regulation of ophthalmic combination products, eight new ophthalmic products were approved in 2022, including innovative combinations such as drug-eluting contact lenses and bispecific antibodies. This trend reflects the industry's recognition of combination therapies' potential to address complex eye conditions more effectively and provide improved treatment options for patients.

The development of combination therapies is further supported by strategic collaborations and research initiatives. In March 2023, Grifols signed a global collaboration and licensing agreement with Selagine for developing immunoglobulin eye drops to treat dry eye disease, combining Grifols' expertise in immunoglobulin development with Selagine's medical expertise. Similarly, in January 2023, researchers at Southeast Technological University (SETU) were awarded funding of up to EUR 705,000 to develop novel eye drop formulations for treating dry eye disease. These initiatives demonstrate the industry's commitment to exploring innovative combination approaches that can potentially revolutionize eye disease treatment by offering more effective and comprehensive therapeutic solutions.

Segment Analysis: By Drug Class

Anti-glaucoma Drugs Segment in Ophthalmic Drugs Market

The anti-glaucoma drugs segment continues to dominate the global ophthalmic drugs market, commanding approximately 35% market share in 2024. This significant market position is primarily driven by the increasing prevalence of glaucoma worldwide and the growing aging population, who are more susceptible to developing glaucoma. The segment's leadership is further strengthened by the continuous introduction of innovative treatment options and improved drug delivery systems. For instance, in 2023, Alembic Pharmaceuticals received FDA approval for its Brimonidine Tartrate Ophthalmic Solution, expanding the treatment options available for glaucoma patients. Additionally, the segment benefits from strong reimbursement policies in developed markets and increasing awareness about early glaucoma detection and treatment in emerging economies.

Ophthalmic Anti-allergy/Inflammatory Drugs Segment in Ophthalmic Drugs Market

The ophthalmic anti-allergy/inflammatory drugs segment is emerging as the fastest-growing category in the ophthalmic drugs market, with an expected growth rate of approximately 9% during 2024-2029. This remarkable growth is attributed to the rising incidence of eye allergies and inflammatory conditions, particularly in urban areas with high pollution levels. The segment's growth is further accelerated by the development of novel drug formulations with improved efficacy and reduced side effects. Recent developments include the launch of preservative-free formulations and combination therapies that offer better patient compliance and treatment outcomes. The segment is also benefiting from increasing research and development activities focused on developing targeted therapies for specific inflammatory eye conditions.

Remaining Segments in Ophthalmic Drugs Market by Drug Class

The other significant segments in the ophthalmic drugs classification include dry eye drugs, retinal drugs, anti-infective drugs, and other specialized medications. The dry eye drugs segment maintains a strong position due to increasing screen time usage and environmental factors affecting eye health. Retinal drugs continue to be crucial in treating age-related macular degeneration and diabetic retinopathy, with several innovative biologics entering the market. The anti-infective drugs segment plays a vital role in treating various ocular infections, while the other drugs category encompasses specialized treatments for specific eye conditions such as myopia and blepharoptosis. Each of these segments contributes uniquely to the overall market dynamics, driven by specific patient needs and therapeutic advancements.

Segment Analysis: By Product Type

Prescription Drug Segment in Global Ophthalmic Drugs Market

The prescription drugs segment continues to dominate the global ophthalmic drugs market, holding approximately 65% of the market share in 2024. This significant market position is attributed to the increasing prevalence of chronic eye conditions requiring prescribed medications, such as glaucoma, age-related macular degeneration, and diabetic retinopathy. The segment's dominance is further strengthened by the extensive pipeline of prescription ocular drugs being developed by major pharmaceutical companies, along with the growing adoption of novel drug delivery systems. Additionally, favorable reimbursement policies for prescription ophthalmic medications in developed countries and the rising awareness about eye health among healthcare professionals and patients have contributed to maintaining this segment's leading position in the market.

OTC Drug Segment in Global Ophthalmic Drugs Market

The over-the-counter (OTC) drug segment is emerging as the fastest-growing segment in the ophthalmic drugs market, projected to grow at approximately 9% from 2024 to 2029. This remarkable growth is driven by increasing consumer preference for self-medication, particularly for common eye conditions like dry eyes and allergies. The segment's expansion is further supported by the rising availability of innovative OTC eye care products, improved accessibility through various retail channels, and growing consumer awareness about eye health maintenance. The trend toward preservative-free formulations and the development of advanced delivery systems in OTC eye drops have also contributed to this segment's accelerated growth. Moreover, the increasing screen time among the global population and the subsequent rise in digital eye strain have created a substantial market opportunity for OTC eye care products.

Segment Analysis: By Disease Type

Glaucoma Segment in Global Ophthalmic Drugs Market

The glaucoma segment continues to dominate the global ophthalmic drugs market, holding approximately 36% market share in 2024. This significant market position is driven by the increasing prevalence of glaucoma worldwide and the growing aging population that is more susceptible to developing this condition. The segment's growth is further supported by the introduction of innovative anti-glaucoma medications and combination therapies that offer better efficacy in managing intraocular pressure. Major pharmaceutical companies are actively expanding their glaucoma drug portfolios through research and development initiatives, while also focusing on developing preservative-free formulations to address the growing demand for gentler treatment options. The availability of various drug classes for glaucoma treatment, including prostaglandin analogs, beta blockers, and combination medications, provides healthcare providers with multiple options to customize treatment plans according to patient needs.

Eye Allergy and Infection Segment in Global Ophthalmic Drugs Market

The eye allergy and infection segment is emerging as the fastest-growing category in the ophthalmic drugs market, projected to grow at approximately 9% CAGR from 2024 to 2029. This remarkable growth is attributed to the rising incidence of eye infections, increasing environmental pollution, and growing awareness about eye health. The segment is witnessing significant advancements in drug development, particularly in the areas of antihistamine eye drops and novel anti-inflammatory medications. Pharmaceutical companies are investing heavily in developing new formulations that offer extended relief and better patient compliance. The segment's growth is also supported by the increasing adoption of over-the-counter eye drops for minor allergies and infections, making treatment more accessible to patients. Additionally, the development of combination therapies that address both allergic and inflammatory conditions simultaneously is driving innovation in this segment.

Remaining Segments in Disease Type

The other significant segments in the ophthalmic drugs list include dry eye disease, retinal disorders, and other miscellaneous eye conditions. The dry eye segment is experiencing substantial growth due to increasing screen time usage and environmental factors affecting eye health. The retinal disorders segment maintains its importance in the market due to the rising prevalence of age-related macular degeneration and diabetic retinopathy. The development of novel drug delivery systems and targeted therapies is enhancing treatment outcomes in these segments. The remaining miscellaneous eye conditions segment encompasses various other ophthalmic conditions requiring specialized treatment approaches. Each of these segments contributes uniquely to the overall market dynamics, with pharmaceutical companies developing specialized solutions to address specific patient needs and treatment challenges.

Global Ophthalmic Drugs Market Geography Segment Analysis

Ophthalmic Drugs Market in North America

North America represents a dominant force in the global ophthalmic drugs market, driven by the increasing prevalence of eye-related disorders, favorable reimbursement policies, and a strong presence of key market players. The region benefits from advanced healthcare infrastructure, particularly in the United States, along with high healthcare spending and rapid adoption of innovative ophthalmic medications. Canada and Mexico also contribute significantly to the regional market, with growing awareness about eye health and increasing access to advanced eye care treatments. The presence of well-established research institutions and ongoing clinical trials further strengthens the region's position in the global market.

Ophthalmic Drugs Market in United States

The United States dominates the North American ophthalmic drugs market, holding approximately 85% of the regional market share. The country's market leadership is attributed to its robust healthcare system, extensive research and development activities, and high prevalence of eye-related disorders. The presence of major pharmaceutical companies, coupled with significant investments in ophthalmic research, drives market growth. The country has witnessed numerous regulatory approvals for novel eye medications, particularly for conditions like glaucoma and age-related macular degeneration. The strong intellectual property protection framework and favorable reimbursement policies further contribute to market expansion, while the increasing aging population creates a substantial patient base for ophthalmic treatments.

Ophthalmic Drugs Market in Mexico

Mexico emerges as a rapidly growing market in the North American region, with a projected growth rate of approximately 7% during 2024-2029. The country's market growth is driven by increasing healthcare expenditure, growing awareness about eye health, and improving access to ophthalmic treatments. The Mexican government's initiatives to enhance healthcare infrastructure and expand coverage for eye-related treatments contribute significantly to market development. The country has also witnessed increased participation from international pharmaceutical companies, leading to greater availability of advanced ophthalmic medications. The rising prevalence of diabetes-related eye conditions and the growing elderly population further accelerate market growth, while improving healthcare insurance coverage enhances treatment accessibility.

Ophthalmic Drugs Market in Europe

The European ophthalmic drugs market demonstrates strong growth potential, supported by advanced healthcare systems, robust research infrastructure, and increasing prevalence of eye disorders. The region benefits from well-established healthcare policies and strong government support for eye health initiatives. Germany, the United Kingdom, France, Italy, and Spain represent the key markets, each contributing significantly to the regional landscape. The presence of major pharmaceutical companies, coupled with increasing research and development activities in ophthalmology, strengthens the market position. The region's aging population and rising awareness about eye health further drive market growth.

Ophthalmic Drugs Market in Germany

Germany leads the European ophthalmic drugs market, commanding approximately 22% of the regional market share. The country's market leadership is attributed to its advanced healthcare infrastructure, strong research capabilities, and high healthcare spending. The German healthcare system's emphasis on preventive care and early diagnosis of eye conditions contributes significantly to market growth. The presence of major pharmaceutical companies and research institutions facilitates continuous innovation in ophthalmic treatments. The country's robust reimbursement policies and increasing focus on personalized medicine in ophthalmology further strengthen its market position.

Ophthalmic Drugs Market in United Kingdom

The United Kingdom demonstrates remarkable growth potential in the European ophthalmic drugs market, with a projected growth rate of approximately 9% during 2024-2029. The country's market expansion is driven by increasing investment in healthcare infrastructure and rising adoption of innovative ophthalmic treatments. The National Health Service's comprehensive coverage for eye-related treatments ensures widespread access to ocular medications. The UK's strong focus on research and development, particularly in novel drug delivery systems and combination therapies, contributes to market growth. The country's aging population and rising prevalence of lifestyle-related eye disorders further accelerate market expansion.

Ophthalmic Drugs Market in Asia-Pacific

The Asia-Pacific ophthalmic drugs market exhibits significant growth potential, driven by large patient populations, increasing healthcare expenditure, and improving access to eye care services. The region encompasses diverse markets including China, Japan, India, Australia, and South Korea, each with unique healthcare dynamics and market characteristics. Rising awareness about eye health, improving healthcare infrastructure, and increasing adoption of advanced ophthalmic treatments contribute to market expansion. The region also benefits from growing research and development activities and increasing presence of both domestic and international pharmaceutical companies.

Ophthalmic Drugs Market in China

China emerges as the largest market in the Asia-Pacific region, driven by its massive population base and rapidly evolving healthcare system. The country's market leadership is supported by increasing healthcare expenditure, growing awareness about eye health, and rising adoption of advanced ophthalmic treatments. The government's initiatives to improve healthcare accessibility and coverage for eye-related conditions contribute significantly to market growth. The presence of both domestic and international pharmaceutical companies, coupled with increasing research and development activities, strengthens China's market position.

Ophthalmic Drugs Market in India

India demonstrates the highest growth potential in the Asia-Pacific region, driven by its large population base, increasing healthcare awareness, and improving access to eye care services. The country's market growth is supported by rising healthcare expenditure, growing prevalence of eye disorders, and increasing adoption of advanced ophthalmic treatments. The presence of a strong pharmaceutical manufacturing base and increasing research and development activities contribute to market expansion. Government initiatives to improve healthcare infrastructure and increase awareness about eye health further accelerate market growth.

Ophthalmic Drugs Market in Middle East & Africa

The Middle East & Africa ophthalmic drugs market shows promising growth potential, characterized by improving healthcare infrastructure and increasing awareness about eye health. The region encompasses diverse markets including GCC countries and South Africa, each contributing to market development. Within this region, GCC countries emerge as the largest market, benefiting from advanced healthcare systems and high healthcare spending. South Africa demonstrates the fastest growth potential, driven by improving healthcare access and increasing adoption of ophthalmic treatments. The region's market growth is supported by government initiatives to improve healthcare services and increasing presence of international pharmaceutical companies.

Ophthalmic Drugs Market in South America

The South American ophthalmic drugs market exhibits steady growth, supported by improving healthcare infrastructure and increasing awareness about eye health. The region, primarily led by Brazil and Argentina, demonstrates growing adoption of advanced ophthalmic treatments. Brazil emerges as the largest market in the region, benefiting from its large population base and improving healthcare system, while also showing the fastest growth potential. The region's market development is driven by increasing healthcare expenditure, growing prevalence of eye disorders, and rising presence of international pharmaceutical companies. Government initiatives to improve healthcare accessibility and increasing focus on eye health contribute significantly to market expansion.

Ophthalmic Drugs Industry Overview

Top Companies in Ophthalmic Drugs Market

The ophthalmic drugs market is characterized by the strong presence of established pharmaceutical giants like Regeneron Pharmaceuticals, Bayer AG, AbbVie, and Santen Pharmaceutical Co. These eye pharmaceutical companies are actively pursuing product innovation through extensive research and development initiatives, particularly in areas like combination therapies and novel drug formulations for conditions such as glaucoma and age-related macular degeneration. Strategic collaborations and licensing agreements have become increasingly common as companies seek to expand their product portfolios and geographical reach. Companies are demonstrating operational agility by investing in advanced manufacturing capabilities and strengthening their supply chain networks. The market is witnessing a trend toward the development of biosimilars and generic alternatives, while companies are also focusing on expanding their presence in emerging markets through local partnerships and distribution networks.

Consolidated Market with Strong Global Players

The ophthalmic drugs market exhibits a relatively consolidated structure dominated by multinational pharmaceutical conglomerates with diverse product portfolios. These major players leverage their extensive research capabilities, established distribution networks, and strong financial resources to maintain their market positions. The market has witnessed significant merger and acquisition activities, particularly involving innovative biotech companies with promising pipeline products. Companies are increasingly acquiring smaller firms with specialized technologies or novel drug delivery systems to enhance their competitive edge.

The competitive landscape is further shaped by the presence of regional players who have established strong footholds in their respective geographical markets through specialized product offerings and local market understanding. Market entry barriers remain high due to stringent regulatory requirements and substantial investment needs in research and development. The industry has seen a trend toward strategic partnerships between global and local players to facilitate market access and enhance distribution capabilities, particularly in emerging markets where healthcare infrastructure is rapidly developing.

Innovation and Market Access Drive Success

Success in the ophthalmic drugs market increasingly depends on companies' ability to develop innovative drug formulations while ensuring broad market access. Incumbent players are focusing on expanding their product portfolios through internal research and development as well as strategic acquisitions, while also strengthening their distribution networks to reach underserved markets. Companies are investing in novel drug delivery systems and combination therapies to address unmet medical needs and improve treatment outcomes. The market is seeing increased emphasis on developing patient-centric solutions and building strong relationships with healthcare providers and payers.

For contenders looking to gain market share, differentiation through technological innovation and competitive pricing strategies has become crucial. Companies need to navigate complex regulatory environments while building robust evidence bases for their products through clinical trials. The threat of substitution from alternative treatments and generic products necessitates continuous innovation and strong patent protection strategies. Success also depends on companies' ability to build strong relationships with key opinion leaders and healthcare providers, while effectively managing pricing pressures from healthcare systems and insurance providers. Future growth opportunities lie in addressing unmet needs in emerging markets and developing specialized treatments for rare ophthalmic conditions. Leading ophthalmic pharmaceutical companies are focusing on these strategies to maintain their competitive edge and secure their positions among the top 10 ophthalmic pharmaceutical companies globally.

Ophthalmic Drugs Market Leaders

-

Bausch Health Companies Inc.

-

Novartis AG

-

Pfizer Inc.

-

Abbvie

-

F. Hoffmann-La Roche Ltd

- *Disclaimer: Major Players sorted in no particular order

Ophthalmic Drugs Market News

- July 2024: Novaliq revealed that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency issued a favorable opinion. They recommend granting marketing authorization in the European Union for Vevizye. This medication is designed to treat moderate to severe dry eye disease in adults, particularly when there's been no improvement with traditional tear substitutes.

- April 2024: Viatris Inc. launched its RYZUMVI (phentolamine ophthalmic solution) 0.75% in the United States to treat pharmacologically induced mydriasis produced by adrenergic agonists (e.g., phenylephrine) or parasympatholytic (e.g., tropicamide) agents.

Ophthalmic Drugs Industry Segmentation

As per the scope of the report, ophthalmic drugs are used to treat various disorders associated with the eyes, such as glaucoma, cataracts, and diabetic retinopathy, to name a few. The ophthalmic drugs market research report is segmented by drug class, product type, and geography. By drug class, the market is segmented into anti-glaucoma drugs, dry eye drugs, ophthalmic anti-allergy/inflammatory, retinal drugs, anti-infective drugs, and other drugs. By product type, the market is segmented into OTC drugs and prescription drugs. By geography, the market is segmented into North America, Europe, Asia-Pacific, Middle East, and Africa, and South America. The industry report also covers the estimated market share and market trends for 17 countries across major global regions. The market research report offers the value (in USD) for the above segments.

| By Drug Class | Anti-glaucoma Drugs | ||

| Dry Eye Drugs | |||

| Ophthalmic Anti-allergy/Inflammatory | |||

| Retinal Drugs | |||

| Anti-infective Drugs | |||

| Other Drugs | |||

| By Product Type | OTC Drugs | ||

| Prescription Drugs | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Middle East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Anti-glaucoma Drugs |

| Dry Eye Drugs |

| Ophthalmic Anti-allergy/Inflammatory |

| Retinal Drugs |

| Anti-infective Drugs |

| Other Drugs |

| OTC Drugs |

| Prescription Drugs |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Australia | |

| South Korea | |

| Rest of Asia-Pacific | |

| Middle East and Africa | GCC |

| South Africa | |

| Rest of Middle East and Africa | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Ophthalmic Drugs Market Research FAQs

How big is the ophthalmology drug market?

The estimated global ophthalmic drugs market size value in 2025 is over USD 34 billion. It is expected to go over USD 51 billion by 2030.

What are the emerging technologies shaping the future of the ophthalmic drug industry?

The emerging technologies shaping the future of the ophthalmic drug industry are a) Nanomedicine b) Sustained-release formulations c) Smart eye drops for controlled delivery.

What are the top selling ophthalmology drugs?

Based on 2023 revenue data available with Mordor Intelligence, these include some of the top-selling ophthalmic drugs: Eylea (aflibercept) by Regeneron Pharmaceuticals and Bayer AG, Vabysmo by F. Hoffmann-La Roche Ltd, Lucentis (ranibizumab) by Novartis AG, Ozurdex by AbbVie Inc. and Restasis by Abbvie Inc.

What is the trend in the ophthalmology market?

Driven by the rising prevalence of eye diseases, an aging population, advancements in treatments, and a growing demand for minimally invasive procedures, the ophthalmology market is on an upward trajectory.

How do regulatory factors affect the ophthalmic drugs market?

Regulatory factors, including the approval process, safety standards, and pricing regulations, play a pivotal role in shaping the ophthalmic drugs market. They influence the time it takes for products to reach the market, the costs associated with their development, and the accessibility of new treatments. While stringent regulations may postpone product launches, more favorable policies can spur innovation and foster market growth.

What challenges does the ophthalmic drugs market face?

The report mentions two main challenges: Loss of patent protection for popular drugs and Lack of health insurance in developing countries.

What are the future opportunities in ophthalmic drugs?

Future opportunities include: Increasing research and development for novel drugs, Growing focus on developing combination therapies, Rising incidence of eye-related disorders, especially among the aging population and Expansion in emerging markets.

Who are the leading market companies in ophthalmic drugs?

Key players in the ophthalmic drugs market include: Regeneron Pharmaceuticals Inc., Bayer AG, AbbVie (Allergan), Santen Pharmaceutical Co. Ltd, Novartis AG, F. Hoffmann-La Roche Ltd, Bausch Health Companies Inc., Alcon (Aerie Pharmaceuticals Inc.), Viatris Inc. and Otsuka Pharmaceutical Co. Ltd.