Mobile Identification Market Size and Share

Mobile Identification Market Analysis by Mordor Intelligence

The Mobile Identification Market size is estimated at USD 5.20 billion in 2025, and is expected to reach USD 17.10 billion by 2030, at a CAGR of 26.60% during the forecast period (2025-2030).

The mobile identification market stands at USD 5.24 billion in 2025 and is projected to reach USD 17.1 billion by 2030, registering a 26.6% CAGR through the forecast period. Expansion is anchored in three structural forces: a steep rise in credential-based cyberattacks, tightening global authentication mandates, and the seamless integration of biometric hardware in mainstream smartphones. Financial services providers are shifting rapidly from passwords to multi-factor and passwordless journeys, while telecom operators, healthcare networks, and governments deploy national digital ID schemes that converge payments, welfare, and public service access. Competitive intensity remains high as established vendors pivot from hardware-centric offerings to software-defined, AI-enabled orchestration layers, and as venture-backed specialists carve out niches in deep-fake detection, behavioral biometrics, and mobile SDKs for app developers. Asia’s policy-driven leap in national ID roll-outs positions the region as the fastest-expanding opportunity pool, whereas Europe balances growth with stringent data-residency restrictions that complicate cross-border deployments.

Key Report Takeaways

- By authentication type, multi-factor authentication commanded 61.95% of the mobile identification market share in 2024; four-factor-and-above configurations are forecast to expand at a 29.2% CAGR through 2030.

- By component, biometric technologies captured 68.5% revenue share in 2024, while the services segment is projected to advance at a 26.8% CAGR to 2030.

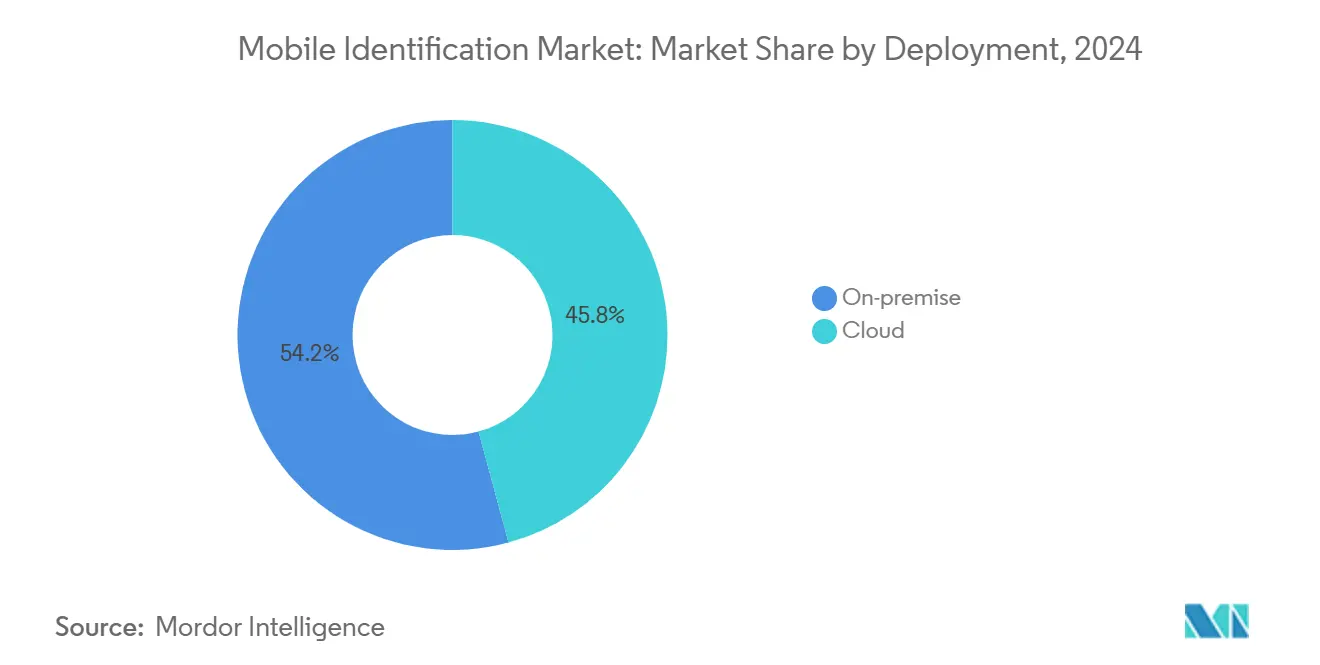

- By deployment, on-premise solutions accounted for 54.2% of the mobile identification market size in 2024; the cloud segment is poised to accelerate at a 26.6% CAGR.

- By application, the BFSI sector led with 33% revenue share in 2024, whereas retail & e-commerce is on track for a 28.5% CAGR.

- By region, North America held 36.75% of revenue in 2024, while Asia is set to outpace all regions at a 28.8% CAGR.

Global Mobile Identification Market Trends and Insights

Drivers Impact Analysis

| Drivers | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| eKYC mandates across BFSI | +3.2% | North America, spillover to Europe | Medium term (2-4 years) |

| National digital ID projects | +4.5% | India, Singapore, China; global influence | Long term (≥ 4 years) |

| Remote workforce zero-trust roll-outs | +2.8% | Europe and United States | Short term (≤ 2 years) |

| Telco-bank SIM-based ID alliances | +1.9% | Africa and Middle East | Medium term (2-4 years) |

| Mid-tier smartphone biometric hardware | +3.7% | Asia-Pacific | Medium term (2-4 years) |

| FinTech and crypto real-time verification | +2.4% | Concentrated in North America and Europe | Short term (≤ 2 years) |

Source: Mordor Intelligence

eKYC Mandates Across BFSI

Financial-services regulators in the United States and Canada are tightening identity-proofing standards, prompting banks to embed real-time biometric checks into mobile apps. Rising fraud losses, estimated at USD 56 billion in 2021, are accelerating multi-factor authentication adoption across credit issuance, digital wallets, and P2P transfers. A parallel wave of streamlined KYC guidance allows self-declarations in markets such as India, cutting onboarding friction without diluting risk controls. Industry working groups now benchmark AI-scored document verification accuracy, and user expectations for frictionless login are driving passwordless pilots in high-risk workflows.

National Digital ID Projects

Asia’s large-scale identity schemes, most notably India’s 1.3 billion-record Aadhaar platform and Singapore’s Singpass ecosystem, embed mobile credentials into payments, healthcare, and public subsidies. These programs anchor a broader 43% CAGR in digital-payment volumes across emerging APAC economies, catalyzing private-sector wallet, lending, and insurance use cases. Early-stage roll-outs in Malaysia and Indonesia highlight implementation hurdles - low opt-in rates and integration gaps - but also reveal long-run capacity to uplift formal economic participation. Global vendors view these government tenders as entry points for cloud-based orchestration layers and country-specific trust frameworks.

Remote Workforce Zero-trust Roll-outs

Enterprises in Europe and the United States rebuilt access-control policies after the pandemic’s shift to hybrid work. Zero-trust architectures authenticate every device and session, leading CISOs to invest in FIDO-compliant, phishing-resistant tokens and facial-recognition SDKs. Treasury reports citing 1.6 million suspicious-activity cases in 2024 elevated board-level scrutiny of legacy password stores. As 80% of breaches trace back to credential misuse, passwordless sign-in journeys that merge behavioral-biometric signals and device attestation are moving from pilot to baseline control.

Telco-bank SIM-based ID Alliances

Mobile-network operators in Nigeria, Kenya, and the Gulf states partner with banks to deliver SIM-rooted Know-Your-Customer layers, leveraging high mobile-penetration rates to circumvent thin branch networks. Checkin.com’s rollout within Ooredoo exemplifies in-device biometric capture that complies with telecom regulations while satisfying bank AML checks. Application-to-person messaging APIs enrich these flows with operator-verified subscriber data, positioning telcos as de facto identity providers.

Restraints Impact Analysis

| Restraints | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| EU data-residency barriers | −2.1% | European Union | Medium term (2-4 years) |

| High spoofing in low-light conditions | −1.8% | Africa, parts of Asia, South America | Short term (≤ 2 years) |

| Fragmented OS security standards | −2.5% | Global multinationals | Medium term (2-4 years) |

| Budget limits for MFA in SME retail | −1.5% | South America; parts of Asia and Eastern Europe | Short term (≤ 2 years) |

Source: Mordor Intelligence

Data-residency Regulations Create Cross-border Friction

The EU Digital Markets Act and Digital Services Act impose strict localisation and gatekeeper provisions that raise compliance costs for U.S.-headquartered cloud-ID platforms.[1]CCIA, “Key Threats to Digital Trade in the European Union,” Computer & Communications Industry Association, ccianet.org Simultaneously, new U.S. rules restrict the export of sensitive personal data to designated countries of concern.[2]Federal Register, “Preventing Access to U.S. Sensitive Personal Data by Countries of Concern,” U.S. Department of Commerce, federalregister.gov Providers operating pan-regional wallets must therefore replicate data stores, reroute API calls, and negotiate sub-processor arrangements, stretching deployment timelines and eroding cost advantages.

High Spoofing in Low-light Environments

Quarterly fraud-rejection rates in East Africa reached 27% in 2024, driven by presentation attacks and poor-quality identity documents.[3]Smile ID, “Fraud Trends in Africa: 6 Key Insights from the 2025 Report,” Smile Identity usesmileid.com Research demonstrates 80% success rates for novel optical-synthesis spoofing devices against leading commercial face-recognition stacks. Vendors respond by integrating dual-spectrum sensors, pulse-detection liveness, and multi-modal fusion with voice or finger-vein checks, yet cost constraints limit adoption in mass-market Android devices.

Segment Analysis

By Authentication Type: Multi-Factor Solutions Consolidate Leadership

Multi-factor frameworks held 62.0% of the mobile identification market share in 2024 as financial services, healthcare, and government portals elevated assurance requirements for high-value transactions. The surge coincides with regulators urging stronger customer authentication and enterprises migrating toward risk-adaptive policies that layer device, biometric, and contextual signals. Four-factor and higher models are projected to grow at a 29.2% CAGR through 2030, driven by national schemes embedding digital signatures and hardware-rooted credentials. While OTP remains widespread, standards bodies champion FIDO-aligned, public-key cryptography to curb SIM-swap and phishing exploits, gradually displacing SMS codes in Western markets.

Adoption dynamics are nuanced: retail-banking apps embed selfie checks mainly during account opening, whereas crypto wallets perform real-time KYC refreshes at each fiat on-ramp. Behavioral-biometric overlays - gauging typing cadence or device grip - offer continuous authentication without undermining user experience. Enterprises balancing security with usability orchestrate these layers via identity APIs that normalise signals across vendors, reducing vendor-lock risk and accelerating policy updates in response to evolving threat taxa.

By Component: Biometrics Anchor Innovation, Services Outpace

Biometric modules generated 68.5% of 2024 revenue, confirming facial and fingerprint modalities as the de facto gatekeepers for consumer apps. Sensor miniaturisation, improved matching algorithms, and on-device AI accelerators have shortened latency and elevated liveness-detection accuracy, consolidating user trust. As government mandates expand, backend orchestration services—document verification, risk scoring, and behavioural analytics - are forecast to outpace hardware at a 26.8% CAGR.

Service-layer differentiation rests on federated-learning models that avoid centralising raw biometrics while still improving fraud-detection heuristics. In addition, vendors monetise add-ons such as continuous credential-health checks, breach-notification feeds, and UI-level SDKs for rapid mobile-app integration, positioning services as high-margin, recurring-revenue streams.

By Deployment Model: Cloud Pivot Gains Momentum

On-premise deployments still accounted for 54.2% of the mobile identification market size in 2024, reflecting data-sovereignty clauses in sectors like defense and critical infrastructure. Yet cloud migration is gathering pace, propelled by elastic capacity, faster update cycles, and subscription economics favourable to mid-market enterprises. Managed-service identity clouds facilitate geographic redundancy, advanced analytics, and shared compliance tooling that would be cost-prohibitive for self-hosted environments.

Hybrid architectures bridge the trust gap: sensitive biometric templates reside on enterprise-controlled hardware-security modules, while edge devices process liveness and scoring algorithms. This split-trust model satisfies regulators demanding local data control without forgoing global resilience and AI-powered fraud signals pooled across tenants.

By Application: BFSI Retains Primacy; Retail-E-commerce Accelerates

Banking, Financial Services and Insurance (BFSI) accounted for 33% of 2024 revenue, underpinned by high-risk transaction flows and strict AML obligations. Mobile-first banking propositions popular in the United States now embed passkeys, selfie-liveness loops, and behavioural analytics as non-negotiable safeguards. Meanwhile, retail and e-commerce operators intersect account-to-account payments, Buy-Now-Pay-Later, and loyalty wallets, propelling the segment toward a 28.5% CAGR.

Merchants calibrate friction: low-value carts clear with device-based risk scoring, whereas high-ticket or cross-border purchases trigger step-up biometric proofing. As deep-fake chargebacks rise, marketplaces roll out seller-verification programs using video-KYC. Convergence of loyalty IDs, payment tokens, and age verification within a single mobile credential streamlines checkout, bolstering both security posture and cart-conversion metrics.

Note: Segment shares of all individual segments available upon report purchase

Geography Analysis

North America maintained a 36.75% revenue share in 2024, supported by robust fintech ecosystems, the world’s highest mobile-banking penetration, and pervasive zero-trust architectures in Fortune 500 enterprises. Regulatory clarity around consent, open-banking APIs, and digital-government service expansion sustains demand across public and private verticals.

Asia-Pacific represents the fastest-growing theatre, with a 28.8% CAGR projected through 2030. India’s Aadhaar-linked UPI rails, Singapore’s Singpass integrations, and China’s provincial ID pilots generate network effects that entice private digital-lending, ride-sharing, and insure-tech players onto shared credential backbones. Mid-tier handset proliferation makes advanced biometrics ubiquitous, narrowing the urban-rural security divide and broadening inclusion.

Europe’s growth is tempered by localisation mandates; nevertheless, the forthcoming EU digital identity wallet regulation obliges all member states to issue interoperable credentials by 2026, creating a multi-billion-dollar procurement wave.[4]Okta, “The 2025 Identity 25,” Okta Inc., okta.com Vendors must certify against eIDAS 2.0 assurance levels and integrate selective-attribute disclosure to meet privacy-by-design prescriptions.

Africa and the Middle East advance through telco-bank partnerships that align SIM registration with real-time KYC. Pan-regional operator consortia leverage GSMA Open Gateway APIs to counter A2P fraud, while Gulf Cooperation Council states pilot mobile-driver-licence schemes that couple residency permits with banking access. Skeletal fixed-line infrastructure in vast rural zones pushes reliance on mobile edge networks, amplifying the importance of lightweight SDKs optimised for intermittent connectivity.

Competitive Landscape

Market concentration is moderate; the five largest suppliers collectively capture about 40% of revenue. Thales and IDEMIA preserve incumbency in government tenders by coupling secure-element manufacturing with cloud orchestration, reinforcing defensible moats in passport, license, and border-control deployments. IDEMIA’s 2025 alliance with a regional telecom operator signals strategic intent to fuse SIM and biometric credentials, shortening customer onboarding cycles and driving network-effect lock-in.

Okta and ForgeRock ride the cloud-native wave, differentiating through developer-friendly APIs, low-code policy engines, and marketplace ecosystems. Okta’s February 2025 acquisition of an AI security specialist enhances its deep-fake detection stack, positioning the firm as a reference vendor for continuous-authentication pipelines.

Emerging niche players exploit gaps: BioCatch scales behavioural biometrics in high-volume fraud scenarios; Jumio specialises in AI-validated document verification; and Checkin.com embeds facial recognition within telco-grade back-ends. Incumbents increasingly form technology alliances—IBM’s quantum-resistant cryptography layer integrates with third-party mobile SDKs, reflecting a coopetition mindset as threat surfaces evolve. Pricing models tilt toward per-verification-event consumption, compressing margins yet broadening addressable market reach among SMEs.

Mobile Identification Industry Leaders

-

OneLogin (One Identity LLC. )

-

Thales Group

-

SecureAuth Corporation.

-

IBM Corporation

-

Micro Focus

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2025: Thales Group launched a new passwordless authentication solution integrating FIDO2 standards with behavioral biometrics, targeting enterprise customers seeking enhanced security without compromising user experience.

- March 2025: IDEMIA partnered with a leading Asian telecommunications provider to implement SIM-based digital identity verification for mobile banking services, significantly reducing onboarding time and fraud rates.

- January 2025: IBM Corporation introduced an enhanced version of its identity management platform with advanced quantum-resistant encryption algorithms, positioning itself ahead of emerging quantum computing threats.

- December 2024: Checkin.com partnered with Ooredoo to implement biometric authentication for customer identification, utilizing ID scanning and facial recognition to streamline customer onboarding and ensure regulatory compliance.

Global Mobile Identification Market Report Scope

Mobile Identification (Mobile-ID) is a service that enables clients to utilize their mobile phones as electronic identification devices. The study covers single-factor authentication, multi-factor authentication, components, and deployment types. Also, it tracks the usage of mobile identification across major end-users such as IT & telecom, retail, healthcare, government and defense, banking, travel, and hospitality. The study also covers demand across various regions and considers the impact of COVID-19 on the market.

| By Authentication | Single-Factor Authentication | |||

| Multi-Factor Authentication | ||||

| By Component | Biometric | |||

| Non-Biometric | ||||

| Services | ||||

| By Deployment | Cloud | |||

| On-Premise | ||||

| By Application | Banking, Financial Services and Insurance (BFSI) | |||

| IT and Telecom | ||||

| Retail and E-commerce | ||||

| Healthcare and Life Sciences | ||||

| Government and Defense | ||||

| Travel and Hospitality | ||||

| By Geography | North America | United States | ||

| Canada | ||||

| Mexico | ||||

| South America | Brazil | |||

| Argentina | ||||

| Chile | ||||

| Colombia | ||||

| Europe | United Kingdom | |||

| Germany | ||||

| France | ||||

| Italy | ||||

| Spain | ||||

| Middle East and Africa | Middle East | Saudi Arabia | ||

| United Arab Emirates | ||||

| Turkey | ||||

| Qatar | ||||

| Africa | South Africa | |||

| Nigeria | ||||

| Kenya | ||||

| Egypt | ||||

| Asia-Pacific | China | |||

| Japan | ||||

| India | ||||

| South Korea | ||||

| Rest of Asia-Pacific | ||||

| Single-Factor Authentication |

| Multi-Factor Authentication |

| Biometric |

| Non-Biometric |

| Services |

| Cloud |

| On-Premise |

| Banking, Financial Services and Insurance (BFSI) |

| IT and Telecom |

| Retail and E-commerce |

| Healthcare and Life Sciences |

| Government and Defense |

| Travel and Hospitality |

| North America | United States | ||

| Canada | |||

| Mexico | |||

| South America | Brazil | ||

| Argentina | |||

| Chile | |||

| Colombia | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Italy | |||

| Spain | |||

| Middle East and Africa | Middle East | Saudi Arabia | |

| United Arab Emirates | |||

| Turkey | |||

| Qatar | |||

| Africa | South Africa | ||

| Nigeria | |||

| Kenya | |||

| Egypt | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

Key Questions Answered in the Report

What is driving the rapid growth of the mobile identification market?

Growth stems from rising cyber-attack volumes, stricter eKYC and zero-trust mandates, and the spread of biometric sensors into mass-market smartphones, jointly pushing the market toward a 26.6% CAGR through 2030.

Which authentication approach commands the largest share today?

Multi-factor authentication leads with 62.0% of 2024 revenue, reflecting widespread regulatory endorsement and proven resilience against credential-stuffing attacks.

Why is Asia the fastest-growing region?

National digital ID programs such as Aadhaar and Singpass, paired with surging smartphone adoption, propel Asia toward a forecast 28.8% CAGR through 2030.

Which region has the biggest share in Global Mobile Identification Market?

In 2025, the North America accounts for the largest market share in Global Mobile Identification Market.

What deployment model is gaining momentum among enterprises?

While on-premise still dominates, cloud-based identity orchestration is accelerating at a 26.6% CAGR thanks to scalability, continuous updates, and lower upfront costs.

How are telcos influencing mobile identification adoption?

Telco-bank partnerships leverage SIM registration data and A2P messaging APIs to deliver streamlined KYC in markets with limited branch infrastructure, notably across Africa and the Middle East.

What are the main obstacles to wider implementation?

Key barriers include EU data-residency rules, high spoofing rates in low-light environments, fragmented mobile-OS security standards, and budget constraints among SME retailers in emerging markets.