Atopic Dermatitis Market Size and Share

Atopic Dermatitis Market Analysis by Mordor Intelligence

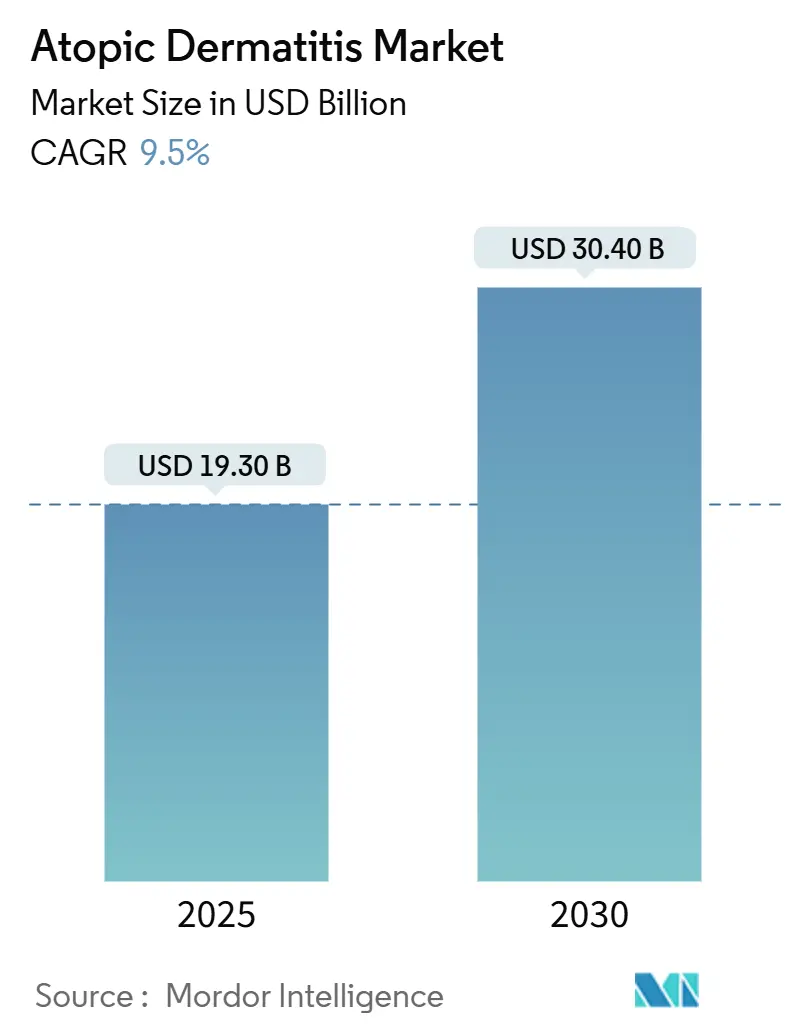

The atopic dermatitis market is valued at USD 19.30 billion in 2025 and is set to reach USD 30.40 billion by 2030, expanding at a 9.5% CAGR during the forecast period. Demand is accelerating as clinicians move away from symptomatic relief toward precision immunology that promises durable disease control. Biologics with room-temperature auto-injectors, oral JAK inhibitors that normalize sleep scores within weeks, and digital tools that document flare-free days are reshaping payer calculus. Large patient cohorts in the United States, Japan, and Germany enable rapid post-launch evidence generation, allowing manufacturers to shorten payback periods for late-stage assets. Meanwhile, decentralized trials in South Korea and Australia are cutting enrollment times, encouraging faster global rollouts and reinforcing competitive pressure on legacy corticosteroids.

Key Report Takeaways

- By drug class, corticosteroids held 34.8% of 2024 revenue, whereas biologics are forecast to grow at a double-digit CAGR through 2030.

- By route of administration, topical formulations represented 61.2% of 2024 prescriptions; injectables record the highest projected CAGR at 11.4% through 2030.

- By patient age group, adults commanded 56.5% therapy spending in 2024, while the pediatric cohort is the fastest-growing segment at a 12.1% CAGR.

- By distribution channel, retail pharmacies accounted for 48.7% of global sales in 2024; online pharmacies and tele-dermatology platforms are advancing at a 13.7% CAGR through 2030.

- By geography, North America led with 41.3% of atopic dermatitis market share in 2024; Asia-Pacific is projected to expand at a 10.9% CAGR to 2030.

Global Atopic Dermatitis Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Expanding adult and geriatric prevalence | +2.1% | North America, Europe, Japan | Long term (≥ 4 years) |

| Rapid uptake of targeted immunomodulators | +2.5% | Global | Medium term (2-4 years) |

| Growing disease awareness and earlier diagnosis | +1.4% | Global | Short term (≤ 2 years) |

| Rising healthcare expenditure and broader coverage | +1.0% | OECD markets, East Asia | Medium term (2-4 years) |

| Proliferation of digital health channels (tele-dermatology, e-pharmacies) enhancing treatment access | +1.6% | Global | Short term (≤ 2 years) |

| Surge in demand for adjunct OTC skin-barrier products | +0.8% | Global | Short term (≤ 2 years) |

Source: Mordor Intelligence

Rising adult and geriatric prevalence

Analyses from high-income countries document a sustained uptick among adults older than 60, driven by microbiome shifts and urban environmental exposures rather than genetics. The enlarged geriatric cohort intensifies demand for polypharmacy-friendly regimens, prompting formulary reviewers to favor cardiovascular-neutral JAK molecules over therapies linked to thromboembolism. Manufacturers are pairing barrier-repair emollients with cytokine blockers to create combination packs that address cutaneous flare and skin integrity simultaneously. Real-world data showing reductions in bacterial superinfection rates among older patients position these therapies as cost-saving even before rebates. Drug-device innovators are responding with needle-shield autoinjectors designed for arthritic hands, broadening adherence in retirement communities.

Rapid expansion of targeted immunomodulatory therapies

The American Academy of Dermatology has elevated monoclonal antibodies such as dupilumab and tralokinumab, along with oral JAK inhibitors including upadacitinib, to first-line status for moderate-to-severe disease. Phase III data on lebrikizumab showed Investigator Global Assessment (IGA) scores of 0–1 in 43.1% of treated patients compared with 12.7% on placebo[1]Silverberg J., “Two Phase 3 Trials of Lebrikizumab for Moderate-to-Severe Atopic Dermatitis,” New England Journal of Medicine, nejm.org. Earlier positioning of biologics enlarges the eligible patient pool and boosts peak revenue forecasts, while longer dosing intervals improve persistence. Pipeline agents targeting IL-31 and OX40L are entering pivotal trials, promising differentiated safety profiles that could undermine entrenched brands. Venture capital inflows are following the mechanistic diversification, pushing smaller sponsors toward licensing deals well ahead of pivotal readouts to capture high valuations.

Growing disease awareness and early diagnosis

Public campaigns now frame atopic dermatitis as a systemic inflammatory disorder connected to anxiety, depression, and asthma, encouraging primary-care referrals before disease severity escalates. As a result, newly diagnosed cases often present with milder lesions suitable for topical phosphodiesterase-4 inhibitors or low-dose JAK tablets. Electronic medical records that capture flare frequency enable payers to validate early intervention as a cost-avoidance strategy, accelerating formulary adoption. Patient-reported outcome apps integrated with these records create longitudinal data sets that translate into robust health-economic dossiers. This evidence not only underpins reimbursement but also guides label expansions into psychiatric comorbidity improvement claims.

Increasing healthcare expenditure and reimbursement coverage

Payers increasingly view controlled atopic dermatitis as a lever for lowering emergency visits and antibiotic prescriptions related to bacterial skin infections. Cost-offset models demonstrate hospital admission reductions when biologics maintain Eczema Area and Severity Index (EASI-75) responses, making high list prices more palatable. Digital health platforms that log return-to-work days provide hard metrics for productivity gains, strengthening the negotiating hand of manufacturers during value-based contract talks. Insurers in Japan and South Korea have begun to reimburse biweekly biologic injections after analyses showed a 22% cut in unscheduled clinic visits. Together, these financial dynamics create headroom for pipeline assets with higher annual costs but superior durability data.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High treatment costs and affordability gaps | -2.6% | United States, Emerging Asia | Short term (≤ 2 years) |

| Ongoing safety and regulatory scrutiny | -1.3% | Global | Medium term (2-4 years) |

| Intensifying price competition and generic erosion in legacy topical therapeutics | -1.1% | Global | Medium term (2-4 years) |

| Limited dermatology specialist availability and access gaps in emerging economies | -0.9% | Sub-Saharan Africa, South Asia, Latin America | Long term (≥ 4 years) |

Source: Mordor Intelligence

High treatment costs and affordability challenges

Average annual out-of-pocket expenses for biologics and JAK inhibitors exceed USD 30,000 in the United States, intensifying socioeconomic disparities in access. Rising coinsurance tiers force patients to seek charity foundations or crowd-funding for initiation doses. In response, payers are tying rebate levels to measurable outcomes such as a 50% fall in EASI scores within six months. Manufacturers that meet these thresholds secure preferred-tier status, but the process increases administrative overhead and delays therapy initiation. Non-profit consortia are piloting subscription models that spread costs over employer groups, yet adoption remains modest given actuarial uncertainties. Without streamlined contracting, uptake among Medicaid populations may lag, softening the atopic dermatitis market growth curve.

Continued safety and regulatory scrutiny

Post-marketing databases flag thromboembolism, herpes zoster, and opportunistic infections with systemic immunomodulators, prompting regulators to enforce boxed warnings and periodic safety updates. Agencies in the European Union now require cardiovascular outcomes data for JAK molecules before five-year renewals, elongating development timelines. Biologics like dupilumab retain an advantage, having accumulated robust safety records across multiple inflammatory indications[2]Sanofi Press Office, “Dupixent sBLA Accepted for FDA Priority Review,” sanofi.com. Sponsors are shifting toward selective cytokine targeting—such as IL-13 blockade—to reduce systemic immunosuppression, but these strategies raise trial complexity as narrow endpoints must demonstrate superiority. Heightened scrutiny therefore redistributes R&D budgets toward precision biomarker programs, potentially slowing launch cadence.

Segment Analysis

By Drug Class: Biologics and JAKs Redraw the Treatment Paradigm

Biologics and JAK inhibitors are gaining share at the expense of topical corticosteroids, which still accounted for 34.8% of 2024 therapy revenue. The transition is fueled by payer recognition that durable cytokine suppression cuts downstream costs from infections and emergency visits. Within the atopic dermatitis market size for biologics, IL-4/IL-13 dual blockers are projected to eclipse JAKs after 2027 thanks to favorable safety profiles and quarterly dosing. Manufacturers now bundle starter kits with digital adherence trackers, reinforcing persistence in the crucial first 12 weeks of therapy. Competitive intensity is pushing developers to file supplemental biologics license applications for label expansions into comorbid eosinophilic esophagitis, extending revenue tails beyond dermatology.

Second-line positioning of JAKs remains robust as they are uniquely effective in taming acute flares. Rheumatologists who co-manage patients with psoriatic arthritis favor JAK molecules for their multisystem efficacy, driving cross-indication synergies. Specialty pharmacies report that 58% of new JAK fills come from patients switching off biologics due to injection fatigue. The atopic dermatitis market share for JAKs therefore rises in regions with high tele-dermatology use, where virtual consults shorten prescription cycles. Pipeline assets targeting TYK2 seek to retain oral convenience while minimizing off-target kinase inhibition, an innovation expected to underpin competitive differentiation after 2028.

Note: Segment shares of all individual segments available upon report purchase

By Route of Administration: Convenience Reshapes Delivery Preferences

Topicals dominated 61.2% of prescriptions in 2024, underscoring their role in mild disease and maintenance regimens. Foam and lotion formats with quick-dry aesthetics improve school-day adherence in adolescents. Manufacturers are embedding QR codes on packaging that link to instructional videos, halving nurse call-backs for application guidance. Although topicals drive volume, injectables command revenue owing to higher annual therapy costs and biweekly dosing schedules that enhance quality-of-life scores. The atopic dermatitis market size for injectable biologics is poised to climb at a double-digit CAGR through 2030, driven by room-temperature autoinjector approvals that enable home administration.

Oral formulations occupy a middle ground between ease of use and systemic potency. Patient preference studies in the United Kingdom show that 67% of moderate-to-severe cohorts would switch to an oral if efficacy were within 10 percentage points of their current biologic. This finding guides pipeline strategy toward once-daily tablets with rapid onset times. Transdermal patches in early development could disrupt both topicals and orals by delivering steady micro-doses of JAK inhibitors across 24 hours, potentially reducing peak-trough side effects. Such innovation underscores how delivery route continues to influence market segmentation more than molecular class alone.

By Patient Age Group: Adults Dominate Spend, Pediatrics Accelerate Growth

Adults represented 56.5% of global therapy spending in 2024, reflecting higher disease persistence, independent purchasing power, and a greater propensity to step up to biologics. Yet, the pediatric cohort delivers the steepest growth trajectory as label expansions extend down to six months of age. Sleep disruption, mood disorders, and school absenteeism among adolescents sharpen payer focus on early intervention. Family practitioners increasingly recommend once-daily PDE-4 inhibitors as first-line therapy, building brand familiarity that may translate into lifelong loyalty. Within the atopic dermatitis market size for pediatric segments, topical pipelines focusing on preservative-free emulsions gain traction with caregivers wary of long-term steroid exposure.

Adult sub-segments are fragmenting by comorbidity profiles. For instance, cardiometabolic risk factors guide clinicians toward biologics over JAK inhibitors in patients over 50. Digital dosing diaries linked to smartwatch heart-rate monitors provide physicians with real-time safety signals, enabling tailored regimens. Women of child-bearing age constitute another sub-segment where fetal safety data for certain biologics influence prescribing. This granular stratification allows manufacturers to employ targeted marketing, optimizing resource allocation across life-stage cohorts.

Note: Segment shares of all individual segments available upon report purchase

By Distribution Channel: Digital Platforms Compress the Supply Chain

Retail pharmacies captured 48.7% of global distribution in 2024, aided by established insurance billing and inventory management systems. Expansion of point-of-care dermatology kiosks inside large pharmacy chains shortens diagnostic lead times, funneling new prescriptions directly to in-house dispensing. Yet the fastest-growing node is online pharmacies integrated with tele-dermatology portals. Patients upload lesion photographs, receive prescriptions within hours, and can auto-refill biologics that arrive in temperature-controlled packs. Co-pay assistance programs embedded at checkout reduce abandonment rates by as much as 18%, enhancing manufacturer return on promotion spend.

Specialty pharmacies remain critical for high-touch biologics requiring cold-chain logistics and nursing support. These outlets orchestrate prior-authorization paperwork, accelerating time-to-therapy in complex payer ecosystems. Manufacturers are partnering with specialty channels to roll out adherence analytics dashboards that flag missed refills within 48 hours, allowing nursing teams to intervene early. Direct-to-consumer shipping of starter doses further compresses the supply chain, sidelining regional wholesalers. Overall, e-commerce adoption not only diversifies revenue streams but also generates granular utilization data that inform pricing negotiations.

Geography Analysis

North America, with a 41.3% atopic dermatitis market share in 2024, remains the anchor for global commercial strategy. The United States alone incurred USD 7 billion in direct and indirect costs last year, bolstering payer willingness to reimburse high-priced biologics when real-world evidence demonstrates hospital avoidance. Robust specialist networks expedite post-marketing studies that regulators in Europe and Asia consider when approving subsequent indications. Dupixent’s pending bullous pemphigoid label exemplifies how U.S. data catalyze global expansion, reinforcing the region’s influence on pipeline prioritization.

Asia-Pacific is forecast to post a 10.9% CAGR through 2030, the steepest among all regions. Urbanization in China, South Korea, and Southeast Asia is intensifying environmental triggers, enlarging the treatable population. Simultaneously, expanded public reimbursement in Japan and healthcare reform in Australia are lowering out-of-pocket costs. Global sponsors conduct decentralized trials in Seoul and Sydney to accelerate enrollment, familiarize prescribers with novel mechanisms, and gather local safety data crucial for National Health Insurance listings. However, heterogeneity persists: while Japan supports biologic launches at parity with Western prices, India’s private-pay segment remains sensitive to modest co-pay increases. Multinational companies thus pursue multi-tier asset deployment, reserving biologics for affluent urban centers and offering economical steroid-sparing topicals in emerging markets.

Europe remains a major revenue pool but faces intensifying cost-containment pressure. Voluntary price agreements like the United Kingdom’s VPAS cap annual growth in branded medicine outlays, prompting some manufacturers to exit the scheme altogether[3]E. Mahase, “AbbVie and Eli Lilly Leave UK Pricing Scheme over Revenue Repayments,” BMJ, bmj.com. Germany’s AMNOG framework demands head-to-head evidence against low-cost topicals, delaying biologic price negotiations by up to 18 months. Nonetheless, Europe’s stringent pharmacovigilance platforms generate transferable data sets that satisfy post-marketing commitments in North America and Asia, reducing redundant surveillance costs. To secure favorable reimbursement, sponsors increasingly highlight macro-economic benefits such as reduced absenteeism and improved mental-health outcomes rather than solely clinical metrics.

Competitive Landscape

The atopic dermatitis market is moderately concentrated, with blockbuster Dupixent surpassing USD 14 billion in 2024 global sales. Its first-mover advantage, broad safety dossier, and multi-indication reach sustain leadership despite new entrants. Yet commercialization tensions are rising: Regeneron’s litigation alleging incomplete transparency in Sanofi’s contracting underscores the financial stakes as exclusivity windows narrow biospace.com.

Eli Lilly and AbbVie are reallocating capital from mature autoimmune franchises toward next-generation programs that combine oral convenience with biologic-like efficacy. Lilly’s lebrikizumab targets IL-13 and demonstrated superior IGA responses versus placebo in Phase III trials, positioning it to challenge Dupixent’s dominance among biologic-naïve patients. AbbVie’s upadacitinib sustained durable EASI-90 rates through Week 52 in open-label extensions, reinforcing its role in rapid flare control. Emerging players such as Arcutis Biotherapeutics command attention by focusing on patient-centric formulation science; its roflumilast cream 0.15% employs a hypoallergenic base that enhances tolerability—a differentiator in chronic application settings.

Strategic alliances focus on co-promotion rights that preserve geographic flexibility. Japanese company Kyowa Kirin partnered with U.S. dermatology specialists to co-develop an IL-31 blocker, ensuring parallel regulatory submissions in the United States and Japan. In supply chain innovation, Samsung Biologics expanded fill-and-finish capacity for third-party monoclonal antibodies, reducing lead times ahead of European launches. Across the board, firms are experimenting with subscription contracts wherein payers pay a flat fee per patient for unlimited drug supply, a model that could recalibrate competitive positioning if validated in state Medicaid pilots.

Atopic Dermatitis Industry Leaders

-

Sanofi

-

AbbVie Inc.

-

Eli Lilly & Co.

-

Pfizer Inc.

-

Leo Pharma A/S

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- February 2025: The U.S. FDA accepted a supplemental biologics license application for Dupixent to treat bullous pemphigoid after pivotal data showed clinically meaningful remission versus placebo.

- September 2024: Independent equity research flagged Eli Lilly and AbbVie as top-quartile growth stories within large-cap pharmaceuticals, reflecting investor confidence in deep immunology pipelines.

- July 2024: The FDA approved ZORYVE (roflumilast) for mild-to-moderate atopic dermatitis in patients aged six and older, adding competitive pressure in non-steroidal topicals.

- May 2024: Health Canada accepted a supplemental New Drug Submission for roflumilast cream 0.15%, widening its North American regulatory footprint.

Global Atopic Dermatitis Market Report Scope

As per the scope of this report, atopic dermatitis, also known as atopic eczema, is often related as just a 'skin condition,' a misconception people think can be dealt with on their own. However, it impacts the patient's life physically and emotionally.

The atopic dermatitis sector is segmented by drug class (corticosteroids, emollients/moisturizers, il-4 and pde4 inhibitors, calcineurin inhibitors, antibiotics, and other drug classes), route of administration (topical, oral, and injectable), and geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America).

The market report also covers the estimated market size and trends for 17 countries across major global regions. The report offers the value (USD million) for the above segments.

| By Drug Class | Corticosteroids | ||

| Emollients / Moisturizers | |||

| IL-4, IL-13 & JAK (PDE4) Inhibitors | |||

| Calcineurin Inhibitors | |||

| Antibiotics & Antiseptics | |||

| Other Drug Classes | |||

| By Route of Administration | Topical | ||

| Oral | |||

| Injectable / Parenteral | |||

| By Patient Age Group | Pediatric (0-17 yrs) | ||

| Adult (18+ yrs) | |||

| By Distribution Channel | Hospital Pharmacies | ||

| Retail Pharmacies & Drug Stores | |||

| Online Pharmacies & Tele-dermatology Platforms | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Middle-East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Corticosteroids |

| Emollients / Moisturizers |

| IL-4, IL-13 & JAK (PDE4) Inhibitors |

| Calcineurin Inhibitors |

| Antibiotics & Antiseptics |

| Other Drug Classes |

| Topical |

| Oral |

| Injectable / Parenteral |

| Pediatric (0-17 yrs) |

| Adult (18+ yrs) |

| Hospital Pharmacies |

| Retail Pharmacies & Drug Stores |

| Online Pharmacies & Tele-dermatology Platforms |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| South Korea | |

| Australia | |

| Rest of Asia-Pacific | |

| Middle-East and Africa | GCC |

| South Africa | |

| Rest of Middle East and Africa | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Key Questions Answered in the Report

What is the current atopic dermatitis market size and expected growth?

The atopic dermatitis market stands at USD 19.3 billion in 2025 and is projected to reach USD 30.4 billion by 2030, achieving a 9.5% CAGR.

Which drug class is growing fastest?

Biologics—especially IL-4/IL-13 dual blockers—are expanding the quickest, driven by robust safety data and quarterly dosing convenience.

Why is Asia-Pacific the fastest-growing region?

Urbanization, better diagnostics, and expanding public reimbursement in countries like Japan and South Korea propel the region’s 10.9% CAGR.

What is the role of biologics in atopic dermatitis?

Biologics, especially IL-4 and PDE4 inhibitors like Dupilumab, are key in atopic dermatitis treatment, with new options in phase II trials targeting immune pathways.

How do high drug costs influence access?

Payers increasingly use value-based contracts that tie rebates to clinical outcomes such as EASI score reductions, ensuring affordability aligns with efficacy.

Which companies lead innovation?

Sanofi and Regeneron dominate with Dupixent, while Eli Lilly, AbbVie, and Arcutis Biotherapeutics drive next-generation programs targeting narrower cytokine pathways.